a16z's Comprehensive Annual Report: The Current State of Web3, Business Boundaries, and Regulatory Innovation

Part One: Why Web3 Matters So Much

The adoption of Web3 technology is evolving in a way that benefits consumers

Cryptographic Technology Addressing Current Pain Points:

Second Part: Current State of the Cryptocurrency Industry

Third Part: Policy Principles and Framework

Roundup of Events in the Crypto and Web3 World

Andreessen Horowitz’s annual “State of Crypto” report shares data on Web3 activities and innovations. The “Policy Focus” from November 2023 in the report gathers insights for U.S. policymakers and others interested in the current state of crypto policy. The report includes:

Part 1: Why Web3 Matters So Much

Web3 is a form of the internet more beneficial to consumers, with advantages and applications far beyond financial services.Part 2: The Current State of the Crypto Industry

Cryptocurrency has become indispensable due to its ability to transcend partisan and identity boundaries. However, the U.S. may be losing its leading position.Part 3: Policy Principles and Frameworks

How to maintain competitiveness in emerging technological innovations while protecting consumers?

Part One: Why Web3 Matters So Much

The internet is one of the most significant technological innovations in human history. However, it often leaves the consumers, creators, and developers who rely on it feeling disappointed.

The adoption of Web3 technology is evolving in a way that benefits consumers

* Web1 (1990 - 2005)

Managed loosely by various institutions, it involved open technologies (protocols) that anyone could build on, such as email (based on SMTP) and the web (based on HTTP). Value did not accumulate within the network.

* Web2 (2005 - 2020)

Managed by companies, it consisted of centralized, siloed platforms where decisions could be made by individual entities (e.g., social networks). Value accumulated with a few large tech companies, rather than with the creators of the value.

* Web3 (2020 to present)

Managed by communities, it features decentralized, interoperable services owned and maintained by the network (e.g., Bitcoin, Ethereum, and other blockchains). Value accumulates among users, builders, and the community contributing to the network: developers, entrepreneurs, creators, fans, and other consumers.

Web2 tech giants aim for monopoly, while Web3 emphasizes “decentralization”

Just three companies, Facebook, Google, and Twitter, contribute to one-third of the global internet traffic.

Amazon, Apple, Facebook, Google, and Microsoft alone account for 50% of the total market value of the NASDAQ 100 index, a significant increase from just 25% a decade ago.

Web3 transfers the value of the internet to more individuals through ownership.

Tokens: The Cornerstone of Web3

- Tokens serve as a “unit” of ownership measurement: Tokens can represent ownership of anything, ranging from digital items (like artwork, tickets, or gaming items) to tangible goods (such as clothing, experiences, or even real estate).

- Tokens are fundamental building blocks: Essentially, tokens are not financial instruments. Similar to websites in Web1 and posts in Web2, tokens are basic components in the construction of Web3 networks.

- Tokens empower individuals: Tokens offer a new way for people to control their digital identity across various platforms and services, akin to property rights discussed in the context of the internet.

The uses of tokens extend far beyond speculation…

Blockchain should be a powerful computer, not a gambling den for speculation. There is a fundamental difference between a world driven by speculation and one where the product is a global computer.

Computers

- As a technological innovation, they drive the development of computer science.

- Based on digital trust, they hard-code the rule of “incapability of evil” into their operations.

- Feature high operational transparency and strong resilience.

Casinos:

- Gambling is financial speculation, not innovation.

- Based on profit-driven trust, they treat “not doing evil” as a variable choice.

- They operate with a lack of transparency and are extremely fragile.

Managed by communities, networks will become the next generation of the internet.

Advantage: As a new type of computer, what unprecedented capabilities does blockchain possess?

Protecting consumers in the era of advancing artificial intelligence (AI):

- Combatting High-Quality AI Forgeries: In a world inundated with high-quality AI-generated forgeries, cryptographic technologies can help trace the authenticity and origin of what we encounter.

- Democratizing AI Innovation: Unlike relying on large tech companies with vast data and computational resources, cryptographic technologies democratize access to these resources, benefiting a broader range of builders.

- Unveiling the AI “Black Box”: AI need not be a black box unknown to all regarding what happens and where data originates. Cryptographic technologies can make the data used by AI more transparent and auditable while protecting data privacy.

- Data Ownership Belongs to the Individual: Cryptographic technologies can implement data privacy within AI models and also assist companies in providing incentives to consumers and creators for their contributions to the data.

Traditional Privacy Systems Upgrade:

- Apple charges mobile consumers up to 30% fees on purchases. With significant pricing and decision-making power in mobile distribution, Apple dominates this space. Cryptographic technology can reduce the fees platform owners extract from users (as a percentage of platform revenue), fostering increased competition and offering more choices for consumers.

- Annually, people spend $647 billion on remittances, with an average cost of 6.25%. Cryptographic technology can eliminate unnecessary intermediaries and cut up to $40 billion in international transaction fees.

- Only 18% of social media users trust the data protection services offered by Facebook. In Web3, individuals own their data - from the posts they create, to the music they produce, to the networks they build. More importantly, they can transfer their network and data from one platform to another.

Cryptographic Technology Addressing Current Pain Points:

- Identity Issues: Unlike relying on large platforms to manage user identities, Spruce empowers people with control and ownership of their identities. Organizations can also manage the lifecycle of digital credentials, similar to how California’s DMV is handling mobile driver’s licenses.

- Monetization for Creators: In streaming services, only 18,000 musicians (less than 0.2%) earn over $50,000 annually. Sound eliminates intermediaries, enabling artists to monetize directly with their fans.

- Carbon Neutralization: The voluntary carbon credit market system is opaque and inefficient. Flowcarbon directs more funds directly to essential environmental projects.

- Censorship and Deplatforming: Biased platform leaders can decide the rules and coverage of social networks. However, the decentralized social network protocol Farcaster allows users to choose between applications while easily moving (and owning) their data.

- Infrastructure Issues: The lack of competition in the telecommunications industry leads to high prices and uneven coverage. Helium is working on providing 5G everywhere through decentralized wireless infrastructure, at a fraction of traditional costs.

- Online Collaboration Opportunities: The narratives, production, and responsibility sharing of intellectual property. Story Protocol and Adim offer open infrastructure to help people co-write, remix, collaborate, and create roles while protecting intellectual property and compensating creators.

Second Part: Current State of the Cryptocurrency Industry

The Web3 era has arrived: Millions of Americans now hold cryptocurrencies, and their usage continues to grow.

Over 40 million Americans hold cryptocurrency, with ownership transcending clear party and identity lines:

Between 16% and 20% of U.S. adults (approximately 40 to 50 million people) have purchased cryptocurrency.

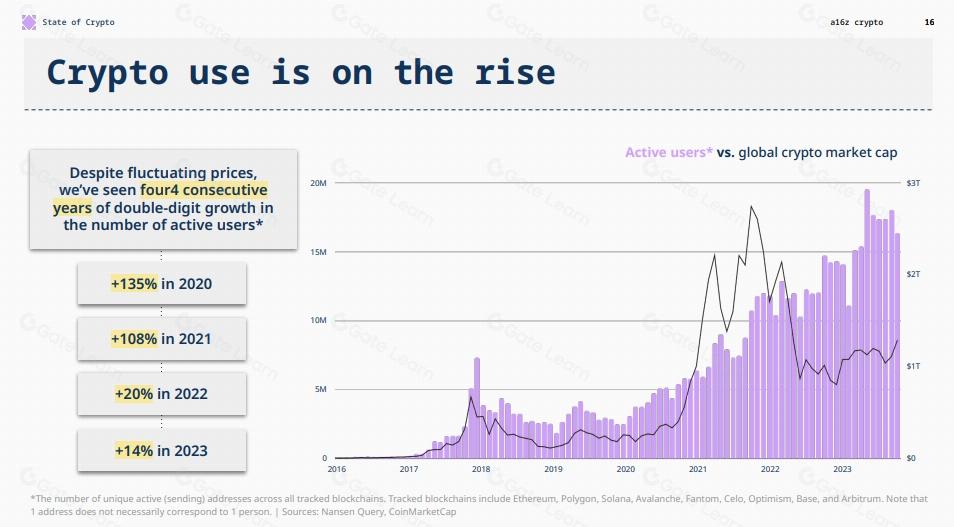

Cryptocurrency usage is on the rise. Despite price fluctuations, the number of active users has maintained at least double-digit growth annually for four consecutive years.

The data tracks the number of unique active (sending) addresses on all blockchains being monitored, including Ethereum, Polygon, Solana, Avalanche, Fantom, Celo, Optimism, Base, and Arbitrum. Note: One address does not necessarily correspond to one individual. Sources: Nansen Query, CoinMarketCap.

The number of institutions researching cryptocurrencies is growing, and their work is advancing other fields. Over 21,000 cryptocurrency publications are dedicated to addressing primary issues:

- Financial Compliance with Privacy Protection: Employing zero-knowledge proofs, which are rapidly evolving from theory to practice.

- Combating Misinformation: Using cryptographic methods to verify authenticity.

- Balancing Artificial Intelligence: Utilizing blockchain networks and decentralization.

- Blockchain Performance and Security: Exploring cryptographic economic game theory, network security, and more.

The Importance of American Leadership:

Leading in Web3 innovation is crucial for maintaining the competitiveness of the United States, which also has implications for national security.

The U.S. has always been a beacon of technological innovation, but it risks losing its leading position in the Web3 arena.

The graphic illustrates the proportion of cryptocurrency developers in the U.S. (left) and the global traffic percentage for U.S.-based cryptocurrency websites (right).

More developers are dedicating their efforts to developing cryptocurrency projects outside the U.S. time zones. The trend in the timing of coding by independent cryptocurrency developers is as follows:

The majority of Github commits occur during U.S. working hours (Eastern Time, 9 AM to 9 PM).

Most Github commits also take place during working hours in the UK and its regions (British Summer Time, 9 AM to 9 PM).

The UK is showing an active inclination towards cryptocurrencies, with a16z’s crypto startups entering the UK ecosystem. Note: This analysis only indicates a directional trend; overlapping time zones or other working hours factors should be considered.

Like the semiconductor industry, the cryptocurrency sector might soon migrate away from the United States. A historical lesson in industry innovation shows us that, taking semiconductors as an example, today’s manufacturing in the U.S. should not rely on foreign suppliers for critical technologies. Excessive dependence on infrastructure can have significant impacts on our daily lives. Similarly, the United States should take a leading role in shaping the future of distributed computing infrastructure, encompassing the internet, organizations, and work.

The Status of the U.S. Dollar Amidst Threats from Sovereign Digital Currencies:

- The current state of global Central Bank Digital Currencies (CBDCs): The development of China’s Central Bank Digital Currency (CBDC) has posed a threat to the status of the U.S. dollar as the world’s reserve currency. As of June 2023, transactions involving the digital yuan have reached a total of 250 billion U.S. dollars.

Stablecoin Innovation Could Strengthen the Dominance of the US Dollar

What is a stablecoin? A stablecoin is a type of cryptocurrency that is nominally pegged to a stable asset, such as the US dollar. [For more information on the types of collateral, refer to an article in the Financial Times.]

Stablecoins could enhance the efficiency of the US payment system and solidify the US dollar’s status as the global digital currency.

This effort is not just about protecting Silicon Valley startups; it’s about maintaining the United States’ global leadership. The US can prevail using a free-market approach, as opposed to centralized planning. This bottom-up approach is likely to result in a multitude of new experiments and innovations. This may be the only way to surpass the central bank digital currencies (CBDCs) of countries like China.

Third Part: Policy Principles and Framework

The U.S.’s innovation-stimulating policies are designed to protect consumers and provide compliant pathways for businesses.

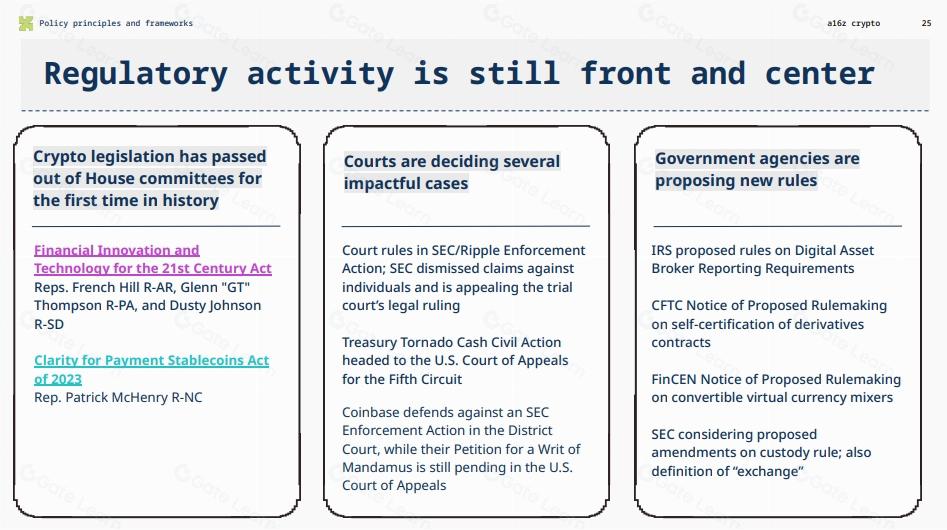

Regulatory activities remain a primary focus:

a. For the first time in history, crypto legislation has been passed in a House committee:

- The “Committees Introduce Financial Innovation and Technology for the 21st Century Act“ was introduced by Representatives French Hill R-AR, Glenn “GT” Thompson R-PA, and Dusty Johnson R-SD.

- The “Clarity for Payment Stablecoins Act of 2023“ was introduced by North Carolina Representative Patrick McHenry.

b. Courts are making multiple rulings on influential cases:

The court ruled in the SEC/Ripple enforcement action; the SEC dismissed claims against individuals and appealed the preliminary court’s legal rulings.

c. Government agencies are proposing new rules:

- The U.S. Internal Revenue Service (IRS) proposed rules for digital asset broker reporting requirements.

- The U.S. Commodity Futures Trading Commission (CFTC) notice of proposed rulemaking on self-certification of derivatives contracts.

- FinCEN’s notice of proposed rulemaking regarding convertible virtual currency mixers.

- The SEC is considering proposed amendments to custody rules and the definition of “exchange”.

Effective regulation can combat bad actors and protect consumers.

Former legislators and agency heads suggest three actions for U.S. lawmakers:

a. Protect Consumers: Require centralized companies to register and be regulated. Regulatory bodies should investigate risks arising from hosting relationships, conflicts of interest, and the use of digital assets in illegal finance.

b. Provide Compliance Pathways: Legislation should offer a compliance path based on disclosure for entrepreneurs who have been building decentralized networks and legitimate businesses, despite an uncertain environment.

c. Incentivize Community Ownership: Laws and regulations should appropriately incentivize decentralization and community ownership — the core promise of web3 technology that benefits the public and paves the way for future innovation.

Guiding Principles and Regulations of U.S. Cryptocurrency Policy:

a. Prohibit new business models or technologies that could harm American values and drive innovation and employment elsewhere.

b. Establish appropriate and clear rules through institutional guidance and legislation. This not only protects consumers but also fosters healthy competition for all, including allowing new innovators to challenge entrenched centralized participants and the regulatory power of existing enterprises.

c. Legitimate businesses and their customers should have access to financial services and legal protections—from banking relationships to data privacy.

d. The focus of regulation should be on businesses, not the broad, decentralized, autonomous software that underpins innovation. (Regulate applications, not protocols)

Misconception: Cryptocurrency is Used Mainly for Illegal Activities

Total vs. Illegal Transaction Volume:

Blockchain analysis companies estimate that illegal transactions account for less than 2% of all cryptocurrency activity. As of 2022, such activities constitute about 0.10-0.24% of all cryptocurrency activities.

Fiat Money Laundering: Money laundering through fiat currencies far exceeds that through cryptocurrencies. By 2021, it’s estimated that the amount laundered in traditional financial markets could be 100-250 times greater than that in cryptocurrencies, as per the head of anti-financial crime technology at Nasdaq.

Methods of Fiat Money Laundering (cash, bank transfers, real estate, etc.) significantly surpass cryptocurrency in both volume and percentage.

Fact: Cryptocurrencies Can Aid in Fighting Crime

Preference for Traditional Financial Products and Services: Criminals and terrorists still prefer traditional financial products and services over cryptocurrencies. Despite these groups seeking any means, including emerging technologies, for funding their activities, the U.S. Treasury Department’s 2022 National Terrorism Financing Risk Assessment found that compared to other methods, the use of “limited other financial products and services”—due to blockchain’s traceable nature—is less advantageous for these groups.

Blockchain Transparency and Traceability: Blockchains are public, traceable, and immutable. This makes them useful in investigations, prosecutions, and asset recovery. Fiat currencies, especially cash, are hard to trace and are still more frequently used in criminal activities.

Role in Crime Fighting: Cryptocurrencies play a role in combating crime. Law enforcement agencies have been highly effective in tracking cryptocurrency activities using sophisticated analytical tools. Governments around the world have demonstrated their capability to recover funds through these means.

Misconception: All Cryptocurrencies are Harmful to the Environment

Estimated Annual Energy Consumption by Product/Industry

Currently, other industries and companies consume far more energy than Ethereum. Why? In September 2022, Ethereum switched to a Proof of Stake (PoS) consensus mechanism (on which many developers choose to build applications), thereby reducing energy consumption by 99.9%. All blockchains require such consensus mechanisms because they are decentralized; the PoS method for network consensus consumes significantly less energy than the Proof of Work (PoW) method used by Bitcoin.

Disclaimer:

- This article is reprinted from [ChainCatcher]. All copyrights belong to the original author [a16z crypto]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.