Binance Research Institute: A Deep Analysis of Ethereum's Evolution Post-Merger

1.Main Content

2. Background Introduction

3.The Merge

4. Sharding

5. Neutral Transactions

6. Verkle Trees

7. Verification Without the Need for Vast Hard Drive Space

8. Coordination

9. Conclusion

1.Main Content

- While Ethereum’s transition to Proof of Stake (PoS) represents a significant milestone, it is merely one among many pivotal upgrades set for the future. A focal point of the Ethereum roadmap is to amplify computational throughput without compromising on decentralized verification.

- Layer-2 is perceived as the most efficient route to achieve scalability, aligning with a rollup-centric vision. Notably, as on-chain data posting costs reached a record high in 2023, Layer-2s have continued to gain traction, seeing a year-on-year growth of 257.7%.

- Danksharding is Ethereum’s approach to becoming a truly scalable, unified settlement and data availability layer. Proto Danksharding (EIP-4844), a precursor to Danksharding, introduces Blob transactions, which are dedicated storage spaces for data availability. Blobs operate within a multi-dimensional EIP-1559 fee market, where two resources, gas and blobs, have fluctuating prices and limits. The use of blobs offers substantial advantages for Layer-2, presenting a more cost-effective solution than the current calldata space rollups.

- The journey towards Danksharding also encompasses vital elements like data availability sampling, KZG commitments, and the separation of proposers and builders. Each path ultimately serves the end goal of centralized block production paired with decentralized trustless block verification.

- The Verkle tree is a crucial step towards a stateless Ethereum. These data structures enable nodes to validate blocks without storing the entire state database.

- The hefty requirements for disk space have impeded widespread node access, undermining decentralization. Historical expiration (EIP-4444) and state expiration aim to minimize the storage burden of historical data, thus eliminating technical debt.

- Other significant upgrades enhancing Ethereum’s infrastructure include single-slot finality, distributed validator techniques, secret leader elections, and the recent account abstraction.

2. Background Introduction

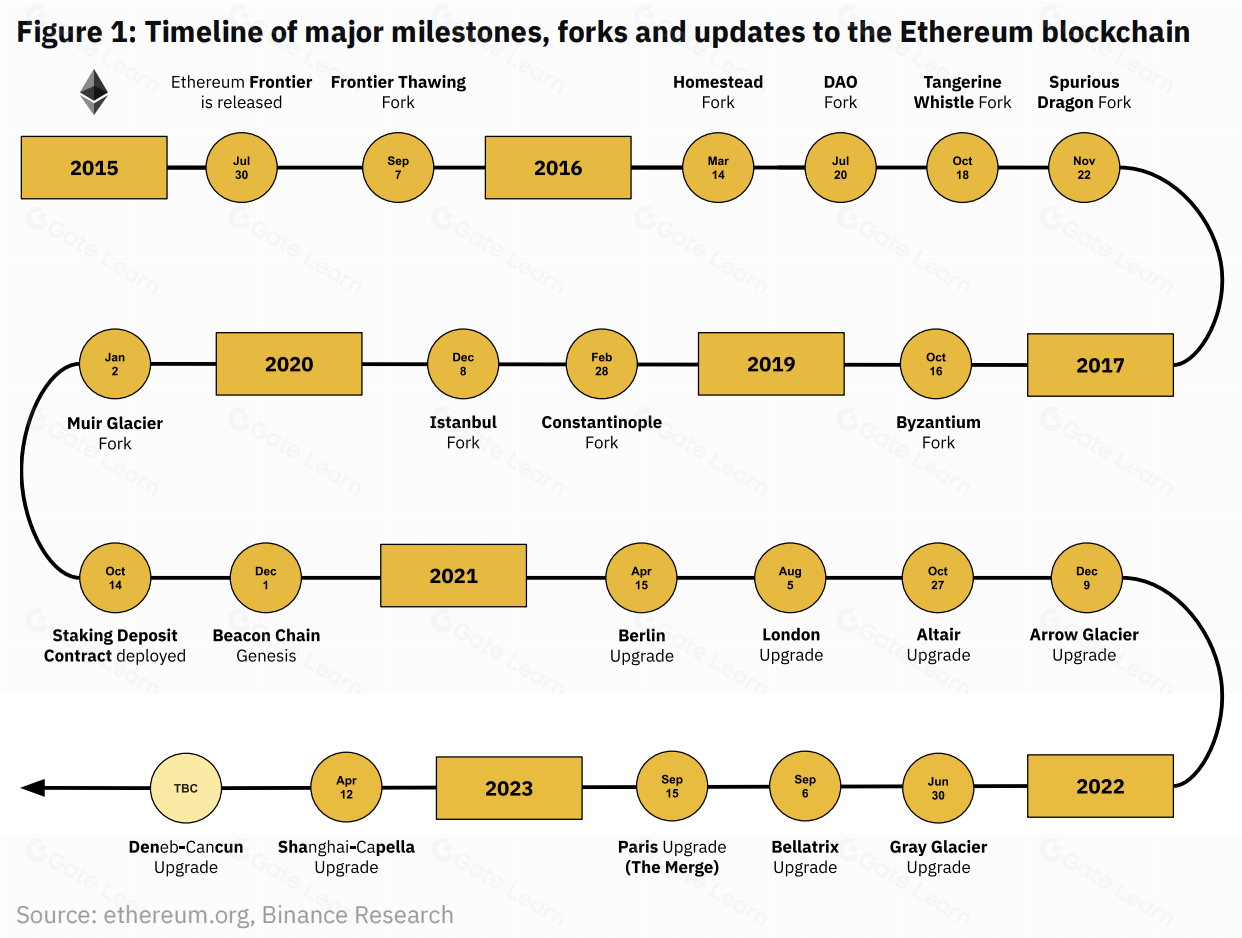

Ethereum, launched in 2015, profoundly transformed the blockchain industry by establishing a global settlement layer. Despite the emergence of many well-funded, competing smart contract blockchains, Ethereum remains the leader in this domain. It boasts the most extensive developer community and a diverse array of decentralized applications (dapps). Currently, the platform has over $21 billion in Total Value Locked (TVL), with a market capitalization second only to Bitcoin, nearing $200 billion. Figure 1 chronicles some of Ethereum’s significant milestones over recent years. Each milestone substantially propelled Ethereum’s growth, enhancing its scalability, security, and decentralization. As Ethereum continues to amplify its influence in the critically vital Layer 1 (L1) ecosystem, it’s unsurprising that the cryptocurrency community grows increasingly curious about the roadmap and future of this dominant L1. After all, any changes in the leading L1 could potentially ripple through the broader cryptocurrency market, creating far-reaching impacts.

Figure 1: Major milestones, forks, and update timelines of the Ethereum blockchain.

Nowadays, Ethereum’s roadmap is meticulously documented and shared openly, enhancing transparency and providing ecosystem participants with a forward-looking framework. The roadmap’s structure aligns with the vision of its co-founder, Vitalik Buterin, outlining the path forward through six succinct phases: the Merge, the Surge, the Scourge, the Verge, the Purge, and the Splurge. Each phase is anticipated to have a transformative impact on the broader blockchain domain.

The Merge undoubtedly marks a watershed moment in blockchain history. However, Ethereum’s transition from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism is just one of many significant strategic upgrades. A key focus of the development roadmap is to enhance scalability, especially the second layer (L2) rollup, aiming to achieve Ethereum’s overall goal: to increase computational throughput without compromising decentralized verification.

Figure 2: Ethereum’s roadmap is divided into distinct non-continuous phases.

Importantly, these upgrades are developed in parallel, not sequentially, with each phase having its own specific goals and thematic emphasis. According to Vitalik Buterin, once these upgrades reach their zenith, Ethereum can be considered fully developed and capable of processing an impressive 100,000 transactions per second (“TPS”).

It’s worth noting that while Ethereum hasn’t formally adopted this category-based terminology, it has opted for a more user-centric approach, yet its vision aligns with Vitalik Buterin’s classification. In the following sections, we will delve deeper into the key initiatives within each roadmap category. First, we will discuss Ethereum’s transition to PoS, examining its implications and anticipated outcomes. Subsequently, we’ll delve into the content following the “merge,” exploring some of the pivotal subsequent stages listed in the roadmap.

3.The Merge

Similar to Bitcoin, Ethereum initially adopted the PoW consensus mechanism, allowing a distributed network of anonymous participants to reach consensus on transaction verification and blockchain entries. However, Ethereum has always envisioned transitioning to the PoS mechanism. In this system, block producers (referred to as validators under PoS and miners under PoW) operate full nodes, stake the native tokens of the protocol, and propose or verify blocks based on a set selection process. On September 15, 2022, Ethereum marked a historic milestone with the implementation of “The Merge.” Vitalik Buterin himself commented on the significance of this event, stating that The Merge completed approximately 55% of the network’s development.

In essence, “The Merge” signifies Ethereum’s shift towards the PoS system, driven by two key upgrades: Bellatrix and Paris, which include Ethereum Improvement Proposals (EIPs) EIP-3675 and EIP-4399. The Merge involves linking Ethereum’s original Execution Layer (EL) with its newly established PoS consensus layer (CL), also known as the beacon chain.

The Merge introduced some crucial modifications that network participants need to be aware of. One significant change requires full nodes to run both EL and CL clients. Before The Merge, an EL client could manage all tasks related to transactions and blocks. After The Merge, the EL and CL clients each maintain their peer networks. While the CL client handles block gossip, attestations, and slashes, the EL client continues to manage transaction execution and state maintenance. These two clients interact through the engine API, together constituting a complete post-merge Ethereum node.

Ultimately, “The Merge” is a vital step towards realizing Ethereum’s vision of creating a highly decentralized, scalable, secure, and sustainable network. Here are some primary benefits brought about by this upgrade:

- Reduced Energy Consumption: By eliminating the need for energy-intensive mining, The Merge cut Ethereum’s energy use by 99.95%. This represents one of the most significant decarbonization efforts in history, reducing global power consumption by 0.2%. Crucially, in an era where environmental, social, and governance (ESG) issues are increasingly in focus, Ethereum’s transition to PoS undoubtedly appeals to ESG-conscious institutions looking to invest in the digital asset market.

- Lower Entry Barriers: Reduced demand for specialized hardware makes it easier for users to become validators and contribute to network security from home.

- Decreased ETH Net Issuance: The Merge brought significant changes to Ethereum’s monetary policy. By removing miner rewards, which made up a large part of ETH’s daily issuance, the issuance of new ETH tokens was drastically reduced. After The Merge, ETH’s daily issuance dropped by about 88.7%, resulting in a gross annual issuance rate of approximately 0.52% of the total supply. In some cases, due to gas fees burned by EIP-1559, net issuance even experiences deflation.

- Shorter Block Times: Assuming no empty slots, the average block creation time decreased from 13.3 seconds to 12 seconds.

- Enhanced Crypto Economic Security: The transition to PoS increases the economic cost of attacking the network, reducing the risk of Sybil attacks.

- Stronger Finality: The network now provides more robust finality guarantees through penalties and slashing of validators.

- Introduced Yield: Meaningful staking returns are introduced. Validators can also accumulate transaction priority fees and have more opportunities to obtain miner extractable value (MEV).

While “The Merge” has passed, several ongoing developments on the roadmap are noteworthy. For instance, the network later rolled out other upgrades, notably the Capella upgrade and the concurrent Shanghai upgrade. A significant feature of these subsequent upgrades is EIP-4895, which formally introduced the capability to withdraw held Ethereum (ETH). Although these specific upgrades are beyond the scope of this report, readers interested in more details are encouraged to refer to our earlier report titled “Ethereum’s Shanghai Upgrade: By The Charts.”

Distributed Validator Technology

Although Distributed Validator Technology (DVT) isn’t a native protocol development, its introduction signifies another major stride in the Ethereum network’s evolution. Historically, operating an Ethereum node was a technically demanding solo venture, requiring a commitment of 32 Ethereum. Platforms like Lido offer alternative staking methods, but at the expense of decentralization. DVT aims to address this by enhancing the performance and risk profile of validators, fostering greater decentralization in the process.

DVT enables parties to collaboratively pool varying amounts of Ethereum to jointly operate a node, instead of staking 32 Ethereum individually. A crucial component of DVT is Multi-Party Computation (MPC), a system allowing participants to share a single private key, reminiscent of multisignature wallets (“multisig”), which can jointly act as distributed validators. DVT not only strengthens node validation resilience—permitting validators to stand in for each other during hardware failures—but also bolsters security. The shared private key architecture under DVT complicates exploitation by attackers.

However, while DVT brings improvements to the network, it also presents its own set of challenges:

- Additional Vulnerabilities: Incorporating DVT nodes introduces an added component, which might be susceptible to faults or vulnerabilities, layering on additional risk.

- Increased Costs: By distributing the validator role amongst multiple parties, DVT necessitates more nodes, potentially increasing operational costs.

- Longer Latencies: Utilizing consensus protocols between multiple nodes in DVT might result in heightened system latencies.

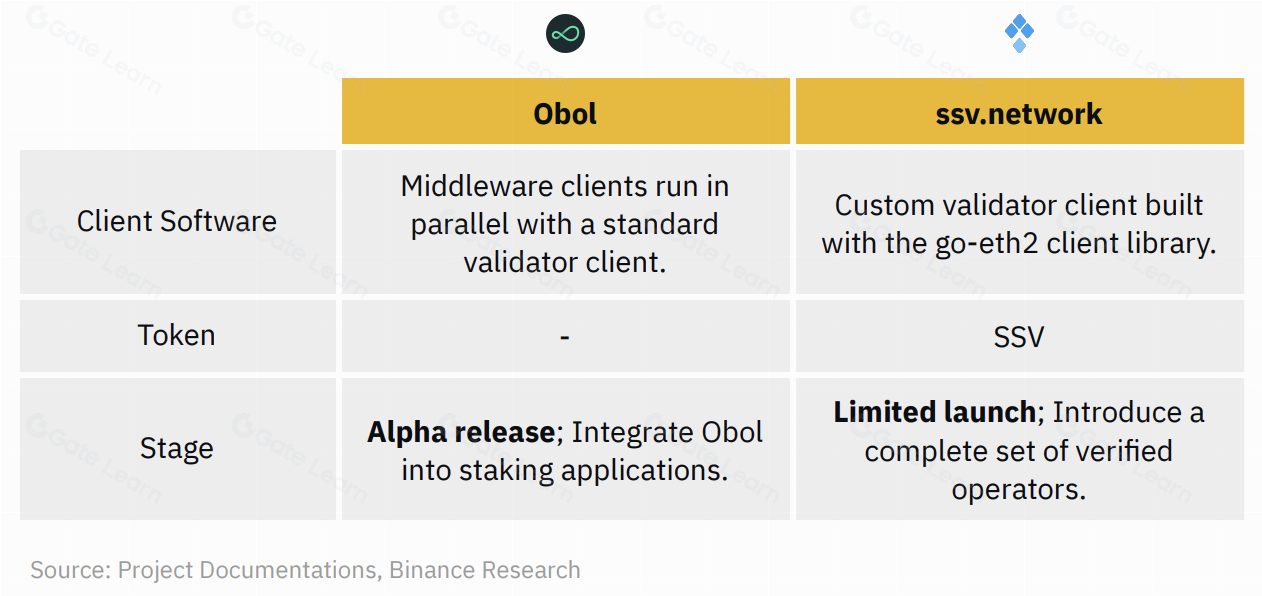

By reducing financial barriers to entry, DVT democratizes Ethereum validator participation. This is especially significant for individuals and small-scale DAOs, as they can engage without needing substantial capital. Consequently, DVT has the potential to dilute the centralized staking dominance seen in platforms like Lido and centralized exchanges (CEXes). The emergence of innovative projects such as Obol and ssv.network aims to harness the advantages offered by DVT. Looking forward, we anticipate DVT use cases will continually emerge in solo staking, staking pools, and Staking-as-a-Service (SaaS), reshaping the market landscape of the Ethereum staking industry.

Figure 4: While still in its infancy, several DVT-based protocols are trending towards launches this year.

Secret Leader Election

In the current PoS consensus model, at the start of each epoch, the identity of the block proposer for each of the 32 slots is public. As a result, their network position can be precisely targeted, opening the door for bad actors to launch Denial-of-Service (DOS) attacks against these known block proposers, aiming to prevent block production. This strategy allows attackers to seize rewards that would otherwise be distributed across multiple blocks. This not only poses a security risk but might disproportionately impact smaller and less secure participants, leading to centralization concerns.

While there are several approaches to address this, such as DVT and Secret Non-Single Leader Election (SnSLE), the most promising solution appears to be Secret Single Leader Election (SSLE). In essence, the purpose of SSLE is to obscure the identity of the proposers in each slot until they actually propose a block, addressing this vulnerability. While the exact implementation details are still under study, current discussions involve using various validator shuffling techniques to maintain anonymity until the formal proposal of a block.

Single Slot Finality

Single Slot Finality (SSF) is another significant upgrade to the Ethereum network. The aim of SSF is to drastically reduce Ethereum’s block finalization time from the current 64 to 95 slots (roughly 15 minutes) to just one slot. As it stands, achieving finality (ensuring a block is permanently part of the blockchain) requires a long wait for transaction confirmation, which is inefficient for applications relying on high transaction throughput. This delay also exposes the network to risks of short-term rewrites, potentially leading to vulnerabilities in block scrutiny and MEV extraction. While accelerating the finalization process can address these issues, it also poses greater computational demands on validator nodes, potentially affecting network participation. Hence, a balance between computational overhead, decentralization level, and finality speed needs to be struck.

To realize SSF, substantial reforms to the existing PoS system are essential. In particular, before implementing SSF, three key challenges must be addressed: developing precise consensus algorithms, optimizing the signature aggregation process, and determining the best methods for validator participation and economic benefits. For a deeper understanding of these areas, Vitalik Buterin’s blog offers extensive details on the topic. Currently, SSF remains in the research phase, expected to launch in a few years, likely after significant upgrades like Danksharding and Verkle Trees.

Looking back, while “The Merge” was transformative for Ethereum’s architecture, it was merely one element in a broader and more comprehensive roadmap. Subsequent stages of Ethereum’s development are closely linked with the outcomes of The Merge. For instance, the transition to PoS paved the way for key enhancements like Danksharding, as it promoted the separation of proposers and builders—a critical factor in enhancing network speed in future upgrades. Now, our focus shifts to other facets of Ethereum’s multifaceted roadmap.

4. Sharding

The primary goal of “The Surge” is to address the longstanding scalability problem that has plagued blockchain technology since its inception. People often pose the question: If traditional financial systems like Visa can process tens of thousands of TPS (transactions per second), why can’t Ethereum achieve similar performance? “The Surge” aims to bridge this gap by focusing on the developmental path to drastically increase Ethereum’s transaction throughput. Specifically, Danksharding (DS) is Ethereum’s method to become a truly scalable blockchain, but its realization necessitates a series of protocol upgrades. We’ll delve into some of these significant upgrades next.

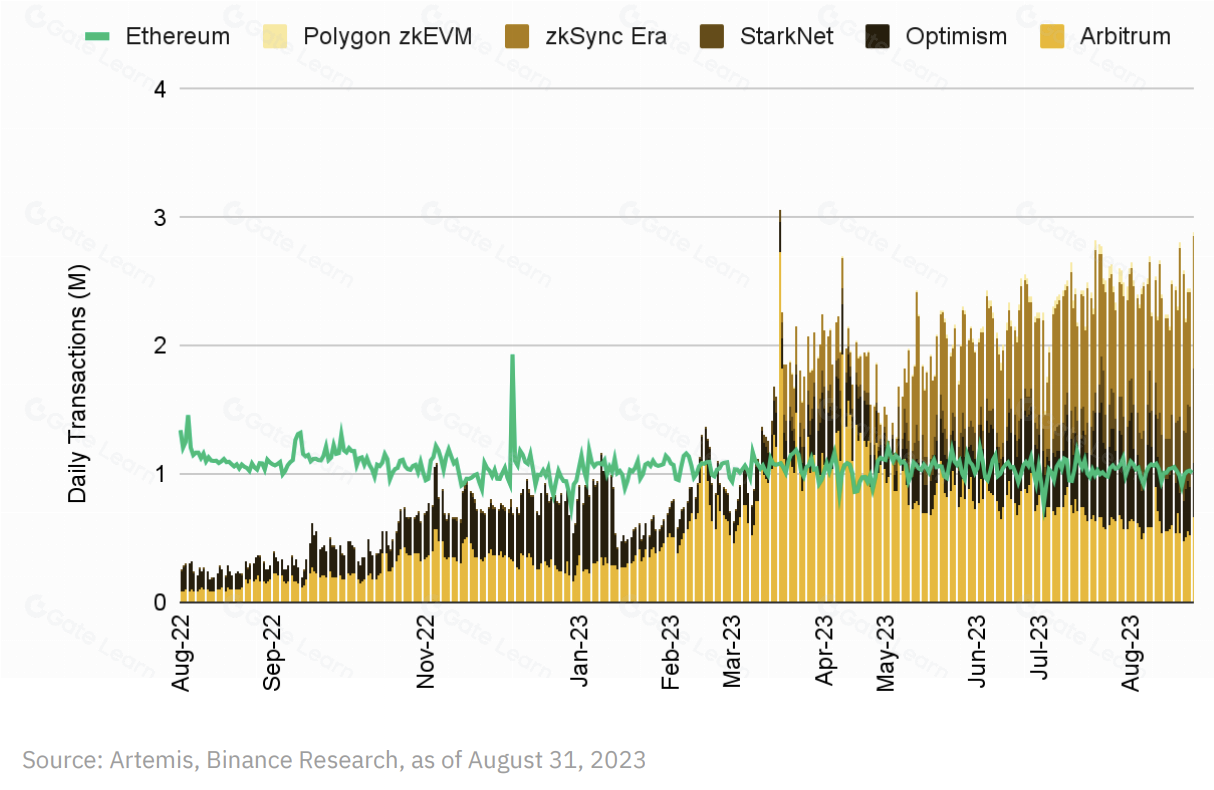

In 2020, with the advent of the rollup-centric roadmap, one of the main reasons for these upgrades became clear. As the term “rollup-centric” suggests, rollups started playing an increasingly important role in the Ethereum ecosystem. In this model, rollups handle the computational heavy-lifting of transaction execution, while the network primarily ensures data availability (DA). This shift was motivated by the maturity of L2 solutions, which demonstrated computational advantages in real-world applications, making them the most convenient pathway to scalability. To underscore this, L2s have been consistently growing, with their daily transaction volume even surpassing Ethereum’s in 2023.

Figure 5: L2 daily transaction volume YoY growth exceeds 600%, signifying their central role in the ecosystem.

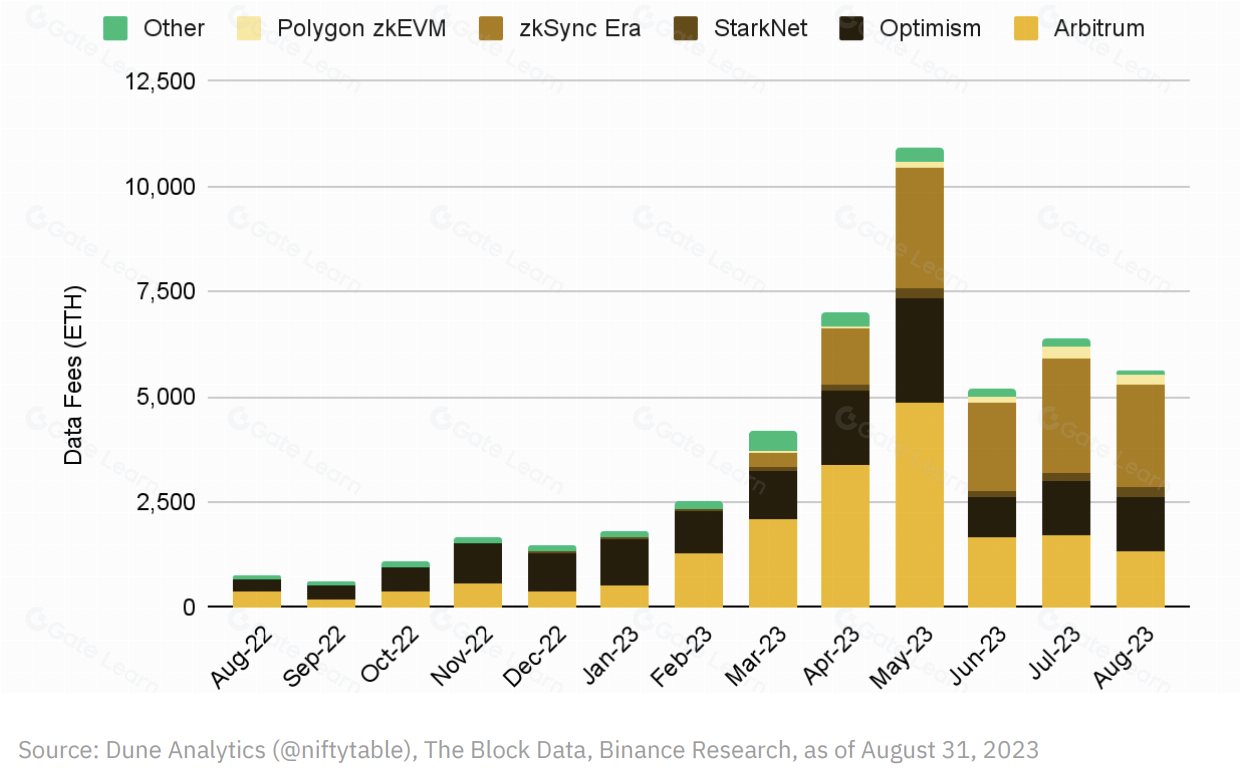

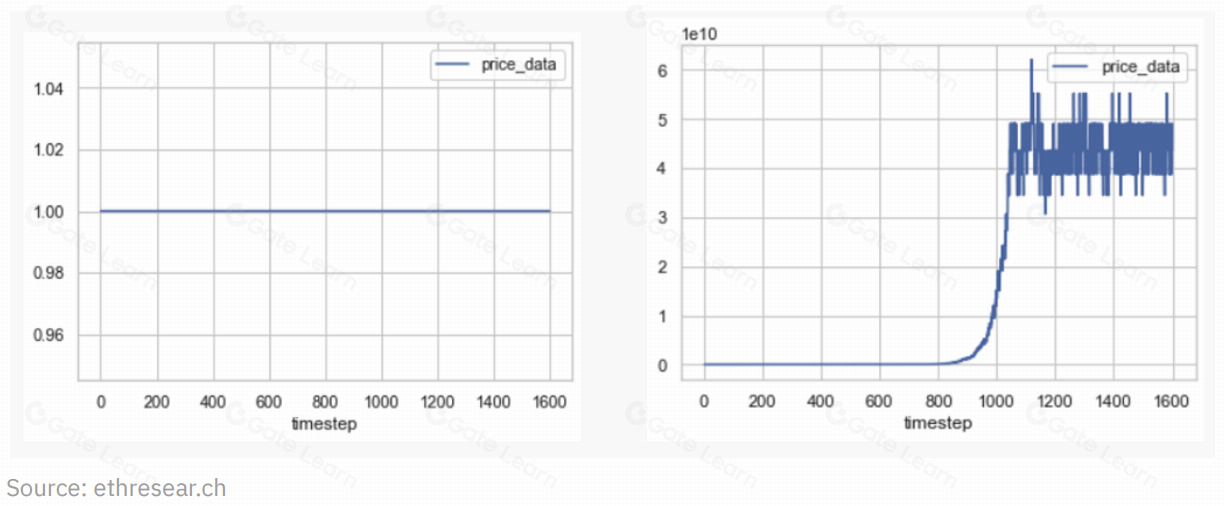

The pivot to a rollup-centric architecture reflects Ethereum’s strategic shift from emphasizing base layer scaling to repositioning its mainnet to focus specifically on consensus, settlement, and DA. This creates fertile ground for L2s to compete freely in transaction execution. From today’s market perspective, given the increasing prominence of L2 rollup technology, this approach seems prescient. In fact, this year saw a sharp spike in L2 adoption, reaching a new peak in May with data posting fees surpassing 10,500 ETH.

Figure 6: Ethereum L2 mainnet data posting costs hit record levels in 2023, growing over 257.7% YoY.

Similarly, an analysis of gas expenditure for publishing L2 data to the Ethereum mainnet shows an upward trend. This growth is largely credited to the innovative optimistic rollups and zero-knowledge (ZK) rollups launched earlier this year. L2s have indeed carved out their niche market, now becoming a viable ecosystem where various dapps can deploy, operate, and evolve seamlessly. With emerging discussions around Layer-3s and Superchains, momentum in this sector is expected to continue, paving the way for eagerly anticipated scalability-focused upgrades that are projected to significantly enhance L2 solution usability.

Figure 7: Ethereum L2’s proportional gas expenditure on L1 data fees shows accelerated growth, indicating rising L2 influence.

While optimistic and ZK rollups have alleviated scalability challenges to some extent, it’s undeniable that they are interim solutions. Current L2s, like Arbitrum and Optimism, still incur suboptimal costs. This isn’t due to inherent flaws in their design but rather limitations of the underlying L1 architecture. Even the fastest rollups occasionally hit bottlenecks, needing to post vast amounts of data to reach consensus on L1, which isn’t designed for efficient data storage.

Figure 8: A snapshot comparison of L2s and Ethereum in the current market.

The DA challenge arises from how current rollups interact with the Ethereum mainnet. They use calldata to post their state roots back to Ethereum for storage. However, calldata isn’t optimized for rollups nor scalable enough to meet their DA demands. These constraints not only elevate L2 transaction costs but also place significant burdens on nodes that have to download this data. Surprisingly, over 90% of rollup transaction fees are spent on these data posting costs. This led to the introduction of EIP-4844, proposed to address these challenges and serve as a starting point towards DS. Although transacting directly on Ethereum remains an option, the goal is to achieve cheaper, faster L2s, expanding Ethereum’s capabilities and diversity.

Proto-Danksharding(EIP-4844)

The forthcoming Deneb-Cancun merger, the Dencun hard fork, is one of Ethereum’s most anticipated upgrades, expected to conclude by year-end. Though details might change, the focus is clearly on EIP-4844, often referred to as Proto-Danksharding (PDS). PDS represents the first step towards Ethereum’s ambitious DS vision and a sustainable scaling solution. Implementing a full DS presents complexities and challenges; hence, the Ethereum community backs the intermediate step of PDS, offering a subset of DS functionalities and facilitating more immediate scaling benefits.

Figure 9: A set of proposed EIPs for the upcoming Dencun hard fork.

EIP-4844 is a critical step in advancing Ethereum’s scaling roadmap, with its main focus being the substantial reduction of operational costs associated with rollups. One of the essential features of EIP-4844 is its capability to considerably reduce DA (Data Availability) costs, which currently constitute a significant portion of L2 overhead. The proposal aims to achieve this by introducing a dedicated storage space solely for DA that is completely isolated from the main block space. This introduces a new type of transaction temporarily held by beacon chain nodes. Simply put, these data chunks, when appended to transactions, not only reduce DA costs significantly but also pave the way for expansive data storage capacity.

The introduction of “Blobs” is expected to revolutionize how data storage is conducted on the Ethereum network. Blobs are substantial, averaging around 125KB each, which is much larger than the typical Ethereum block. Compared to the existing calldata space, utilizing Blobs offers a more cost-effective solution. Once EIP-4844 is implemented, it’s anticipated that the calldata mechanism will be largely supplanted by these Blobs. Essentially, the data space within these blobs is expected to be utilized by L2 rollups to optimize both costs and performance, allowing for a vast number of transactions on Ethereum at a reduced price. Importantly, with the introduction of this tailored data layer, EIP-4844 also sets the stage for experimentation in modular blockchain scaling approaches.

As per EIP-4844’s parameters, the pricing of these blobs (in the form of gas fees) will operate under a distinct market mechanism based on the supply and demand of blob storage. The market for blob fees will function entirely independently from the demand for block space. Thus, Ethereum will operate under a two-dimensional fee market structure comprising:

- The first dimension, operating under EIP-1559, dictating the fee market for regular transactions.

- The second introducing a new blob fee market, where storage costs are directly influenced by the supply and demand dynamics for blobs.

This dual fee market structure is expected to enhance the flexibility and efficiency in the allocation of network resources, making Ethereum more scalable and cost-effective. More crucially, the introduction of independent fee markets is anticipated to boost efficiency, as it segregates the economics of DA from transaction execution, allowing each to be priced according to its specific supply-demand dynamics. Like any early deployment, even amid heightened activity on the Ethereum network, the utilization rate for Blobs is expected to remain relatively low. Consequently, the costs associated with blob storage are projected to be several magnitudes lower.

Figure 10: PDS introduces a tailored data layer, endowing blobs with their independent fee market, complete with distinct floating gas prices and limits.

While PDS (Presumptively Decentralized Storage) is considered a significant leap in Ethereum’s scaling roadmap, its naming might be slightly misleading. For instance, every validator still needs to download all data Blobs, verifying their availability. Hence, this system doesn’t directly implement data sharding as some might anticipate. Nonetheless, PDS does introduce a degree of forward compatibility, smoothing the transition to a full DS once the architecture is finalized. Regardless, this upgrade remains a significant milestone in Ethereum’s evolution, aiming to substantially enhance network capacity, address pressing availability issues, and further align Ethereum with its rollup-centric vision.

Data Availability Sampling

While the full implementation details of DS (Data Sharding) have yet to be finalized, its general approach is easy to grasp: DS checks the work allocation of DA (Data Availability) to validators. To do this, DS employs a procedure known as Data Availability Sampling (DAS). Utilizing erasure coding techniques, specifically Reed-Solomon coding, DAS expands shard data, ensuring the availability of the complete dataset when the sample reaches a certain threshold. Mathematically, this technique guarantees access to the DA as long as over 50% of the samples are accessible. This allows node validators, including light clients, to validate the availability of data without having to download the entire data blob.

Given the potential challenges of rolling out DS, the role of DAS becomes even more crucial. With Ethereum’s increasing adoption, both the number of rollups and the data these rollups need to process will grow, leading to an increasing data burden on network nodes. Without an efficient solution like DAS, only nodes with substantial resources would be able to handle the growing data demands. By streamlining the verification process and reducing the overall data storage requirements, DAS not only ensures data manageability but also promotes decentralization. It encourages more participants to join and maintain the network by reducing the computational burden on individual nodes, thus lowering centralization risks.

Figure 11: Node validators can efficiently verify blocks through DAS.

Furthermore, it’s worth highlighting that the DS roadmap possesses an ambitious scaling strategy, aiming to eventually expand the target blob storage capacity to 16MB. Although the increased block size won’t pose challenges for nodes in the verification network due to DAS’s efficiency, it does create bottlenecks for block constructors responsible for encoding blobs and distributing data. As a result, this development does introduce a set of issues to consider. Specifically, higher demands on block constructors might deter many from participating in the network, tilting the framework towards more centralized structures. To address this, a pivotal upgrade is needed: the “Proposer-Constructor Separation.” This separation aims to balance the computational load among different network participants, thereby preserving Ethereum’s core values of diversity and decentralization. This report will delve deeper into this topic and its significance later on.

KZG Commitment:

The challenge of implementing DAS (Data Availability Sampling) and erasure coding lies in ensuring data is correctly expanded and verifying its accuracy. This is crucial, as erroneous erasure-coded data would render a blob filled with errors or garbage unrecoverable. To address this, the KZG commitment serves as a cryptographic assurance that data has been encoded and expanded correctly.

The KZG (Kate-Zaverucha-Goldberg) commitment uses polynomial commitments to prove commitments to specific values. In other words, while DAS confirms the availability of erasure-coded data, KZG commitments affirm the integrity of the original data. Typically, there are two methods to ensure the validity of erasure-coded data: fraud proofs and ZK proofs. Networks like Celestia use fraud proofs for this purpose, but the Ethereum community has opted for KZG commitments, more specifically, a proposed 2D KZG. Other notable networks like Polygon Avail also employ KZG commitments. Here are some relative advantages and disadvantages of KZG:

- Advantages: KZG is praised for its low latency and assurance of correct erasure coding without relying on the inherent honesty and synchrony assumptions of fraud proofs.

- Disadvantages: KZG isn’t quantum-resistant and requires a trusted setup, which might raise concerns about system integrity. However, the trusted setup in KZG operates under a 1:n trust assumption. This means it only requires one well-behaved participant out of all to maintain the setup’s integrity, making it more robust than it initially appears.

Overall, KZG commitments provide an effective, albeit not entirely perfect, solution to the challenges posed by the implementation of DAS and erasure coding in Ethereum’s scalability roadmap. Nevertheless, to achieve Ethereum’s long-term goal of being entirely quantum-resistant, later stages of Ethereum’s roadmap will likely transition from KZG to another quantum-resistant commitment scheme that doesn’t require a trusted setup. For more details on this topic, we recommend reading “KZG Polynomial Commitments” by Dankrad Feist.

Impact on Layer 2 Rollups:

Initiatives like EIP-4844 and DAS aim to significantly enhance Ethereum’s scalability and performance. These changes will inevitably have a direct impact on L2, which has already carved out its niche in the ecosystem. To better understand this impact, it’s vital to examine the cost structure associated with rollups.

Costs related to rollups are usually divided into fixed and variable costs. Fixed costs include three primary elements: state write fees, validity proofs, and base Ethereum transaction fees. Variable costs mainly comprise L2 gas fees for processing transactions and L1 publishing fees for storing batched data in Ethereum blocks, commonly referred to as calldata costs. The network revenue generated from the gas fees paid by users to rollup operators typically covers these costs.

According to market observations, the primary cost driver for rollup transactions currently is the calldata cost. In fact, using Optimism as an example, calldata costs can sometimes account for over 90% of the rollup transaction fees. This dominance highlights the transformative potential of measures aimed at reducing calldata expenses. Specifically, the implementation of EIP-4844, introducing blob-bearing transactions and DA-specific storage space, could be a game-changer. Therefore, reducing calldata costs can significantly enhance the economic feasibility and scalability of rollups.

Figure 13: L1 publishing fees have always been the primary driver of rollup costs.

EIP-4844 and its anticipated reduction in DA costs will have several ramifications for L2 rollups and the Ethereum ecosystem at large. Although the initial cost reduction will be passed on to end-users without affecting L2’s profitability, that doesn’t tell the whole story. Reduced fees might stimulate increased transaction activity. An increase in transaction activity, in turn, could raise execution costs, potentially boosting the overall profits for L2.

However, it’s essential to understand that the impact of EIP-4844 goes beyond mere cost benefits. By reducing the overhead for high-transaction-load use cases, such as game-based and social dapps, it achieves higher scalability without compromising decentralization or security, effectively breaking the blockchain scalability trilemma. While a full DS (Data Sharding) will be an advanced version to further counteract the scalability dilemma, EIP-4844 lays the foundational framework for these changes using PDS (Partial Data Sharding).

Considering batched data from leading applications like Arbitrum and Optimism, and given the current demand for blob space, we can ascertain that the anticipated demand for blobs will be several orders of magnitude lower than the target blob count. Initial low demand for blob space might lead to reduced blob fees until demand catches up with the target blob count per block. This sets up an interesting market dynamic where price discovery for blobs is postponed until demand exceeds initial block targets. Therefore, during this period, data pricing is expected to remain near base levels, implying a substantial reduction in transaction fees. This attractive cost structure might serve as a powerful catalyst for broader adoption and utilization of Ethereum’s L2 solutions.

Figure 14: Before Blob demand approaches target levels, data pricing is expected to remain close to benchmark levels.

However, introducing blobs comes with the inherent complexities and uncertainties of launching a new market. New markets always suffer from market asymmetries. The uncertainty behind the new fee market might lead to skewed expectations about data costs. Given the initial restrictions on the number of blobs per block and the potential for under-utilization of the full data space, a secondary market for blob pricing might emerge. Hence, in the absence of robust market feedback mechanisms, blob pricing might undergo volatility before reaching a stable price equilibrium.

Despite this, such factors might be secondary considerations, as the overall trajectory of rollups post-PDS remains positive. The incentives from reduced fees are making Ethereum-based rollup transactions one of the most cost-effective blockchain solutions in the medium to short term. The Ethereum community doesn’t take this optimistic outlook for granted and is actively assessing the situation. Topics related to accelerating the Blob fee discovery process—like implementing higher Blob fees or reducing the target number of Blobs—are already under discussion.

It’s worth noting that the ultimate success of EIP-4844 is closely tied to the continuous development of L2, which is currently undergoing market consolidation and may see further changes. Although EIP-4844 certainly aims to enhance the cost-effectiveness of rollups, variables affecting its broader adoption aren’t just limited to PDS and increased DA costs. While rollups are currently more cost-effective than Ethereum, they are still in their infancy and haven’t yet offered the same level of security, usability, or decentralization. Making meaningful improvements in user experience and interoperability remains crucial. Hence, whether a significant volume of transaction activity will shift from Ethereum to cryptocurrencies to fully leverage the offered cost savings remains to be seen.

In conclusion, EIP-4844 aims to enhance Ethereum’s transaction capabilities through PDS while also laying the groundwork for the eventual realization of a complete DS. Specifically, DS sets the expectation for Ethereum to become a unified settlement and DA layer in the long run, unlocking various beneficial use cases for L2. For instance, rollups using validity proofs will be able to make synchronous calls with Ethereum’s EL. This could lay the foundation for new L2 primitives, opening up opportunities for the development of the next generation of dapps. However, it’s worth noting that the full realization of DS might still be years away, requiring further research, consensus, and phased implementations to materialize. PDS is the eagerly anticipated upgrade and the first step towards developing an efficient native DA layer and scalability.

5. Neutral Transactions

The Scourge encompasses a series of upgrades designed to mitigate the centralizing effects of MEV while preserving the fairness and transparency of transaction inclusion. The separation of Proposer and Builder (“PBS”) is the most prominent upgrade, a requirement stipulated by both the DS and stateless roadmaps.

To comprehend the backdrop, one must first understand MEV. At its simplest, MEV represents the additional revenue that miners or validators can earn beyond block rewards and transaction fees. This is achieved by strategically including, excluding, or reordering transactions within a block, rather than adhering to a simple fee-based transaction priority.

While validators have unique advantages in identifying and capitalizing on MEV opportunities (they decide which transactions are included and their order), the majority of MEV benefits are captured by specialized entities known as searchers who employ intricate transaction algorithms. Regrettably, the expertise needed to competitively extract MEV inherently centralizes power, contrasting Ethereum’s principle of maximizing network participation. PBS is Ethereum’s community solution to this issue.

Separation of Proposer and Builder

PBS aims to delineate the dual roles currently played by Ethereum validators: proposing and building blocks. In this model, the validator chosen to propose the next block (i.e., the block proposer) offloads the task of block construction (transaction selection and ordering) to a specialized block builder market. This establishes a unique, in-protocol role for builders, responsible for block construction and bidding for proposers to select their blocks. In a well-functioning market, competitive builders would bid up to the full value of the MEV they can extract from a block, resulting in a majority of the MEV rewards accruing to the diverse set of validators. Thus, PBS effectively combats the centralizing forces of MEV.

The implementation of PBS also means validators lose the ability to individually include or exclude specific transactions, as the content of blocks is now determined by a separate entity. This arrangement offloads the computationally intensive task of block assembly to more specialized entities, allowing validators to operate with lower hardware requirements. This design is particularly beneficial for DS, as its implementation inherently adds to the computational load of block builders. To alleviate the burden on regular validators, PBS plays a pivotal role in the DS roadmap. While this setup centralizes block construction tasks, it retains the decentralized and trustless nature of block validation. This aligns with Vitalik Buterin’s stance in “Endgame”: all paths lead to centralized block production with decentralized trustless block validation.

Details of PBS’s technical implementation are still under consideration, but a dual-slot framework using a commit-reveal scheme has gained traction. Notably, the commit-reveal approach is vital in preventing MEV theft. In this method, block builders submit their bids and preliminary block headers to the proposer. The proposer then chooses a winning bid and header, which is subsequently verified by a committee of attestors. Upon approval, the block builder reveals the full block body.

Fig. 15: Visualization of Dual-Slot PBS.

A distinctive feature of this system is the elimination of a trusted relay acting as an intermediary between proposers and builders. Builders directly submit their bids to block proposers, and these bids are irrevocable, even if a builder fails to deliver a valid block. The unconditional payment structure ensures bidders don’t need to trust builders.

In the meantime, third-party solutions like Flashbots’ MEV-Boost are bridging the gap as PBS is formally integrated into Ethereum. MEV Boost establishes a free market for block construction, effectively segregating the roles of proposers and builders. Here, proposers can maximize MEV returns by delegating block construction tasks to professional builders. A key distinction of the MEV-Boost system, however, is its reliance on a mutually-trusted relay to facilitate block data transfer between parties, ensuring proposers can’t steal MEV from builders. Thus, while the relay system does require some level of trust, its primary function is to verify the validity and existence of the block body, eliminating the need for validators to directly trust builders.

Fig. 16: PBS is currently only achievable through third-party middleware MEV-Boost by running Flashbots.

While MEV-Boost serves as a valuable interim solution, its utility might diminish with forthcoming upgrades, like DS, tailored for builder specialization. In such scenarios, non-specialized validators might find constructing blocks locally challenging. Consequently, it’s anticipated that in-protocol PBS will ultimately encapsulate the advantages MEV-Boost offers. PBS can not only maintain the same role separation but also further decentralize builders and eradicate proposer trust in any other party.

Anti-Censorship List

An important external effect of PBS is the potential exacerbation of centralization, especially concerning transaction censorship. By professionalizing the role of block builders, the upgrade might empower builders to strategically outcompete peers and exclude specific transactions. To counteract this, designs are being considered to ensure resistance to censorship, such as complete block auctions with inclusion lists or partial block auctions. One proposal suggests block proposers publish an anti-censorship list (“crList”) highlighting transactions in the mempool they deem shouldn’t be censored. Builders are obligated to include these transactions from the crList unless they produce a full block. The nuances of these designs are still being refined, marking an important area for future close scrutiny.

Other Focus Areas

Beyond the public budget system, there are other significant areas of interest. For instance, figuring out how to distribute MEV more equitably to counteract its centralizing effects. One idea under consideration is committee-driven MEV smoothing, aiming for as uniform an MEV distribution as possible. Another focal area aims to burn MEV, redistributing its value to all Ethereum holders, not just benefiting Ethereum validators. The last major item on the long-term roadmap explores distributed block construction. While many upcoming Ethereum updates acknowledge the need for specialized builders to alleviate computational loads on validators, decentralized block construction might still be beneficial in the long run. In summary, PBS is in a relatively mature research stage and is a pivotal step in addressing challenges brought by MEV and DS. While PBS largely curtails the centralization risks of block builders, additional mechanisms are needed to ensure transaction fairness and transparency.

6. Verkle Trees

The Verge focuses on a series of upgrades, with the primary objective of implementing statelessness in Ethereum. By eliminating the need for validator nodes to store a full copy of the Ethereum state, The Verge aims to simplify the block validation process, leveraging enhanced proof techniques for this purpose. This change is expected to significantly reduce storage and bandwidth requirements for validators, thereby strengthening decentralization. The ultimate vision of The Verge is to offer lightweight clients the same level of security assurances as current full nodes.

However, the continuous growth of Ethereum’s state data has significantly increased disk space usage, making the storage of such data prohibitively expensive, especially for high-throughput blockchains. This ever-increasing storage demand raises the hardware prerequisites for running a full node, potentially centralizing effects on validators. To address this issue, the Ethereum development community has proposed statelessness and Verkle trees.

Statelessness

Statelessness essentially means there’s no need to have a current state on hand to execute a specific role or function. Specifically, Ethereum aims for weak statelessness, where validators can validate blocks without holding a copy of the entire Ethereum state, though block builders still need state access when constructing blocks. Given the separation of block building from proposing through PBS, this limitation is less concerning. Due to its centralized nature, dedicated block builders can effectively handle state growth.

Witnesses play a crucial role in achieving stateless execution. Essentially cryptographic proofs verifying the correctness of state access, builders will incorporate these proofs in each block. Validation doesn’t require accessing the entire state but only the parts of the state affected by transactions within the block. Block builders will include these specific state segments in every block and have them verified by witnesses.

The adoption of weak statelessness allows Ethereum to scale its execution throughput by alleviating constraints brought about by state growth. While most transaction execution is expected to shift to L2, enhancing L1 throughput still has its merits. For instance, Rollups rely on Ethereum for DA and settlements, necessitating L1 execution. As Ethereum expands its DA layer, the amortized cost of proof submissions could become a significant portion of rollup expenses. However, to achieve weak statelessness, considering the inclusion of witness data and proofs, more bandwidth will be needed. Fortunately, transitioning to Verkle trees will prevent this from being a bottleneck.

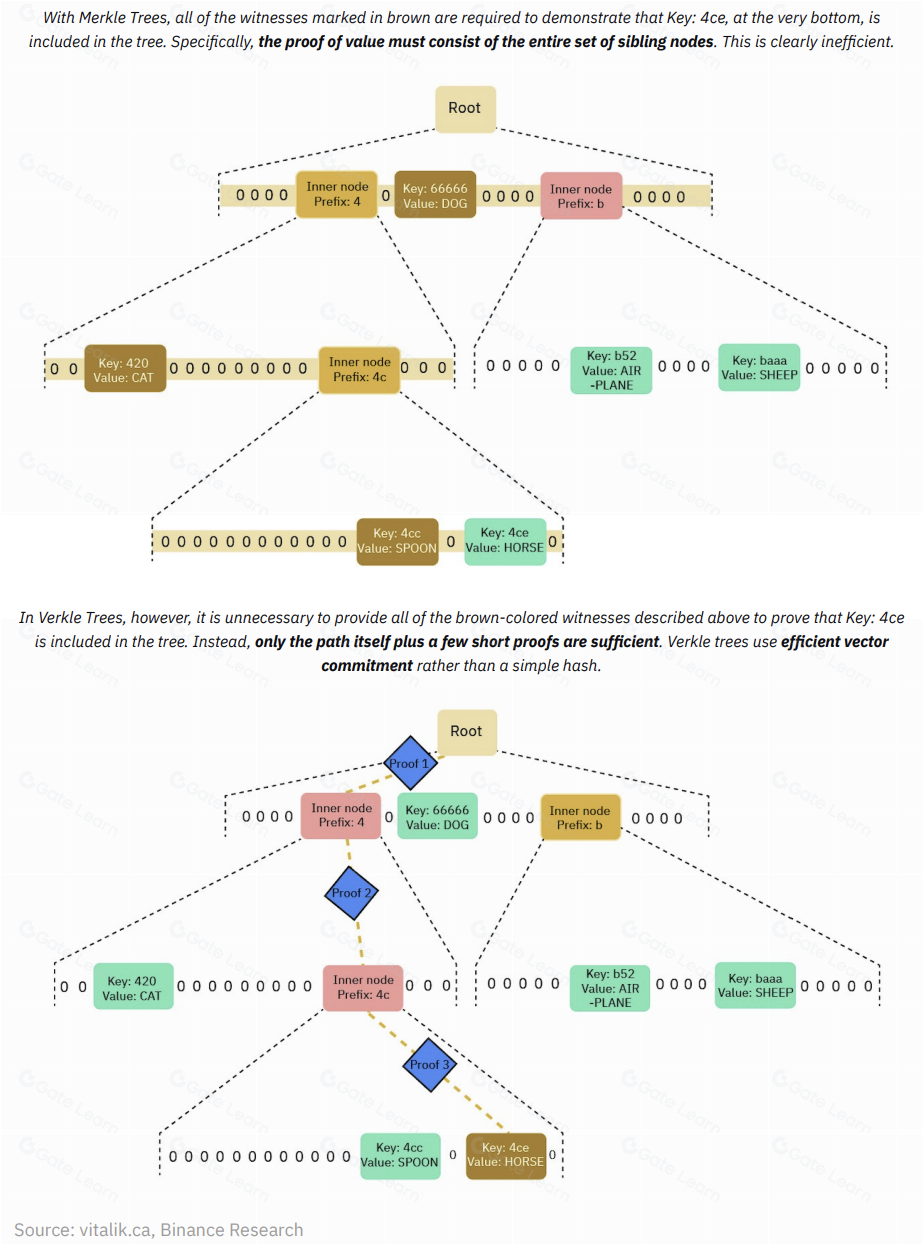

Verkle 树

Currently, Ethereum relies on the Merkle-Patricia Tree to hash and compress its state data. However, the size of the Merkle proofs in this tree structure might become too large, rendering it unsuitable for the witnesses required in the stateless model. To resolve this issue, Ethereum plans to transition to the Verkle tree, a more efficient data structure. Both the Merkle-Patricia and Verkle trees possess the vital ability to generate witnesses (cryptographic proofs), allowing anyone to easily confirm the existence of specific information based on a public state root.

The advantage of Verkle trees lies in their ability to efficiently generate smaller proofs. While Merkle-Patricia Trees require an increasing number of hash values as the tree expands, Verkle trees differ. They utilize vector commitments for scalability without proportionally increasing the proof size. This optimization reduces the amount of data to be transmitted, making stateless validation more feasible.

The shift to Verkle Trees will greatly facilitate the proliferation of stateless clients. Validators will no longer need to maintain a local copy of the entire Ethereum state. Instead, block builders will provide a Verkle proof, encapsulating the state portions related to a specific block. Validators can then use these proofs to validate blocks without accessing the complete state. This approach also allows new nodes to start validating blocks immediately as they won’t need to synchronize the full state history.

Figure 17: Verkle proofs are far more efficient, thus serving as viable witnesses for implementing weak statelessness.

As of now, a testnet for Verkle trees is already in operation. However, before transitioning to Verkle trees, extensive updates are still required for clients. Looking ahead, Ethereum’s objective is to integrate more advanced proof techniques, like zk-SNARK, to further enhance proof efficiency and streamline block validation. As specialized hardware for generating SNARK proofs becomes more advanced, zk-SNARKs will increasingly be used to verify more complex statements. Ultimately, quantum-resistant zk-STARKs will be the end goal, though the current proof-generation time is seen as a limiting factor.

7. Verification Without the Need for Vast Hard Drive Space

The Purge is a series of planned upgrades aimed at streamlining the Ethereum protocol by significantly reducing the burden of historical data storage and eliminating technical debt. This is especially critical for Ethereum, as the ever-increasing historical data and state complexities could raise node storage requirements, affecting decentralization. Once DS is implemented, the stakes are raised, anticipating a substantial increase in the average block size. Of these upgrades, EIP-4444 stands out prominently.

Historical Expiry (EIP-4444)

EIP-4444 proposes the implementation of historical expiration, requiring nodes to cease hosting historical blocks older than one year on the peer-to-peer network. This practice of removing historical data greatly alleviates the disk space demands for node operators. Concurrently, it simplifies client software, removing the need for code to handle different versions of historical blocks. Furthermore, the combination of EIP-4444 with PDS ensures periodic data pruning; EIP-4444 trims annually, while PDS trims monthly blobs. While this aids in reducing the data storage requirements for nodes, it also raises concerns about the preservation and recovery of historical data.

The removal of historical data primarily poses challenges for applications on Ethereum that rely on analyzing past transaction information. Although the storage of historical data is increasingly seen as a best management responsibility outside the core Ethereum protocol, clients still have the capability to import such data from external sources. Various methods may emerge to access historical data outside the Ethereum network, whether through block explorers like Etherscan, indexing services like The Graph, or more decentralized solutions supported by the Ethereum Foundation. Once EIP-4444 is in place, the preservation of historical data will undoubtedly become a focal point of attention.

State Expiry

As previously discussed by The Verge, weak statelessness eliminates the necessity for validators to maintain the entire state for block validation. However, the state won’t simply disappear; its continued growth remains a long-term challenge for the network. To address this fundamental issue, “The Purge” adopts a method called “state expiry.” State expiry automatically deletes parts of the state that have remained static for a set duration (e.g., one year), moving them into a separate tree structure and removing them from the primary Ethereum protocol.

State expiry is one of the more distant upgrades in the Ethereum development roadmap and only becomes viable after migrating to Verkle Trees. While the urgency of state expiry might decrease after the implementation of stateless clients, it can still relieve the burden that dormant accounts and other idle addresses impose on the Ethereum state. Looking ahead, as time progresses, both L1 and L2 throughput are expected to increase. Specifically, the growth rate of L2 states might be faster and might influence high-performance block constructors at some point in the future. Thus, a proactive state growth management strategy is undoubtedly beneficial.

In summary, both historical and state expiry are under active research, and their specifics might evolve with the progression of the roadmap. Before these proposals yield results, other roadmap projects, such as PBS and Verkle Trees, need to be completed first.

8. Coordination

The Splurge is a miscellaneous category used for upgrades that don’t align with the themes of the previous sections. This section covers a series of development outcomes, among which the most notable upgrades include account abstraction, multi-dimensional EIP-1559, and verifiable delay functions.

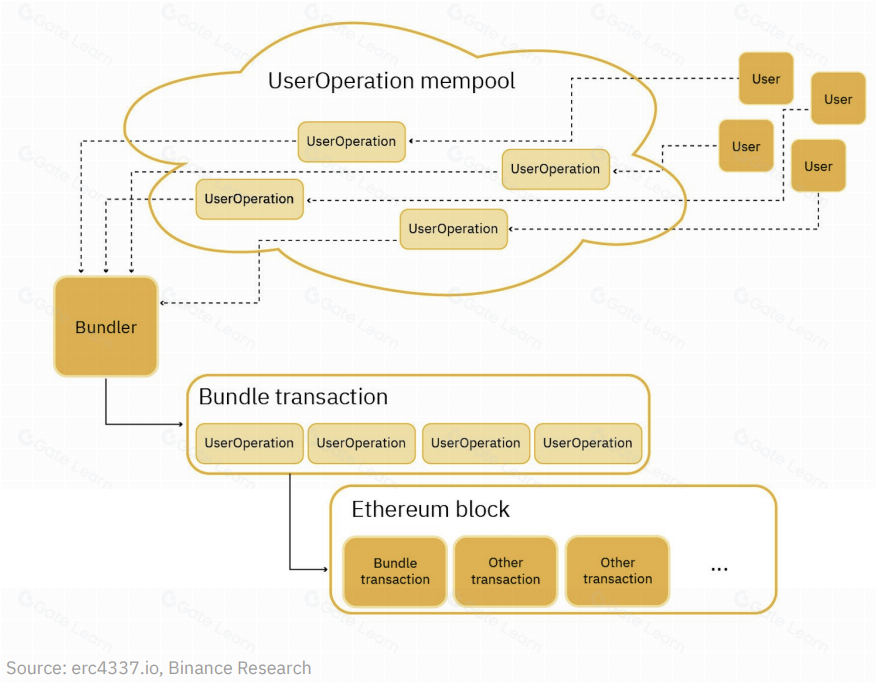

Account Abstraction (ERC-4337)

Account Abstraction (referred to as “AA”) is a pivotal upgrade, with ERC-4337 being one of its most significant proposals. AA refers to the decoupling of the relationship between EOA (Externally Owned Account) accounts and signers. This allows users to utilize smart contract wallets as their primary Ethereum accounts, effectively replacing traditional EOAs, thereby enhancing the overall user experience. Notably, this is achieved by replicating the transaction memo pool’s functionality in higher-level systems, eliminating the need to modify the Ethereum protocol itself.

Figure 18: ERC-4337 doesn’t modify the consensus layer’s logic. Instead, it replicates the transaction mempool functionality in a higher system tier.

Considering the myriad of benefits AA offers, the widespread enthusiasm for it is entirely justified. Some of these advantages include:

- Enhanced Security: AA introduces various verification and recovery options, surpassing the current practice of relying on seed phrases for account recovery and management.

- Improved User Experience: It simplifies the complexities associated with handling EOAs and private keys. AA enables developers to innovate in terms of user experience, such as introducing user-friendly security features and transaction processes, making Web3 wallets as intuitive as Web2 applications.

- Batched Transactions: AA allows users to bundle multiple operations into a single action, instead of authorizing each transaction individually. This provides more convenience for dapps, like games that require frequent transactions.

- Automated Transactions: This feature enables users to set up recurring payments and other automated transactions, which are not feasible with the current EOA system.

- Flexible Gas Payments: AA permits the use of ERC-20 tokens for transaction fees, not just ETH. It also supports third-party gas fee payments, which is particularly advantageous for new users engaging with the network.

Token-Bound Accounts (ERC-6551)

While this upgrade differs somewhat from this stage, the Token-Bound Accounts (“TBAs”) feature of ERC-6551 is a noteworthy development related to AA. ERC-6551 introduces a new standard, allowing NFTs to use permissionless registries as their own smart contract accounts and wallets. This offers a holistic mechanism for owners to custody NFTs within TBAs. With the growing demand for NFT-held assets in scenarios such as gaming, TBAs are designed to overcome obstacles that hinder NFTs from interacting with other on-chain assets. This innovation provides a flexible framework, enriching the functionalities of NFTs without disrupting the existing ecosystem and paving the way for innovative applications and other potential enhancements.

Looking ahead, more EIPs might be introduced, enabling EOAs to transition into smart contract wallets and potentially suggesting mandatory conversions, aiming to simplify the protocol by standardizing all accounts into smart contract wallets. For more information on AA and TBAs, including their growth and adoption, refer to our recent report, “A Primer on Account Abstraction.”

The Multidimensional EIP-1559

The Multidimensional EIP-1559 extends the concept discussed when introducing blob-carrying transactions. Specifically, PDS introduces a multidimensional EIP-1559 fee market where gas and blob, two resources, have independent floating prices and associated limits. The Multidimensional EIP-1559 underscores the potential to enhance gas market efficiency by segmenting costs associated with specific resources consumed in Ethereum transactions. Currently, gas in Ethereum is a combination of various resources, including EVM execution, transaction calldata, and witness data.

The multidimensional fee market aims to address challenges arising from the disparities between average and worst-case loads of these resources. The Multidimensional EIP-1559 dynamically prices each resource based on its supply and demand, effectively mitigating the disparity between average and peak loads. This signifies a notable advancement in resource pricing within the Ethereum ecosystem, aiding in addressing suboptimal gas fees.

Verifiable Delay Functions

Lastly, to truly understand Verifiable Delay Functions (“VDF”), it’s essential to recognize the pivotal role of randomness in PoS blockchains like Ethereum. In the current system, randomness primarily stems from the RANDAO values stored in the beacon state, which are crucial for fairly allocating tasks like block proposals and committee distributions among validators.

VDF enhances randomness by executing a series of non-parallel computations using specialized hardware. This ensures a more secure output, eliminating potential biases. Importantly, the outcomes of these computations can be quickly verified without the need for specialized devices. In essence, VDF provides a more robust source of randomness for Ethereum, vital for the development of certain future applications.

9. Conclusion

Although Ethereum’s transition from PoW to PoS consensus mechanism marks a significant milestone, the platform’s evolution is far from over. With a clear roadmap, the development team is actively implementing various upgrades to harness its full potential.

In essence, SSF will significantly refine Ethereum’s PoS architecture, streamline finality, and offer an enhanced user experience. Starting with PDS, The Surge aims to reduce DA costs and distribute the workload of checking DA amongst nodes, thereby improving scalability, especially for L2. The Scourge employs PBS to counteract the centralizing effects of MEV, reallocating MEV earnings in a trust-neutral manner. The Verge focuses on achieving statelessness by transitioning to Verkle Trees, allowing stateless clients to verify blocks without needing a local copy of Ethereum’s state. The Purge trims historical data storage and technical debt, further simplifying the protocol. Lastly, The Splurge introduces several additional features; a recent significant addition being account abstraction, which expands wallet choices, enhances gas market efficiency, and boosts functionality.

Although many of these upgrades are still in the formulation phase and not fully executed or defined, this report offers a snapshot of the continually evolving landscape. Once fully realized, Ethereum is poised to significantly increase computational throughput while maintaining its leading security and decentralization. This paves the way for Ethereum’s widespread adoption, unburdened by scalability or cost constraints, assisting Ethereum in achieving its goal of establishing a universal, trustless, permissionless DA and settlement layer. We eagerly anticipate the next phase of Ethereum’s roadmap.

Disclaimer: This article is not investment advice. Readers should consider whether any opinions, views, or conclusions in this article align with their particular circumstances and comply with laws and regulations of their country or region.

Disclaimer:

- This article is reprinted from[Binance Research]. All copyrights belong to the original author [Binance Research]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.