Parallel EVM Nova Lumio: The white knight of Ethereum‘s new primitives for scalability

In the post-Cancun upgrade era, Ethereum equivalence is no longer innately correct.

At the heart of Ethereum equivalence is EVM compatibility. The reason why EVM compatibility is important is not only because of the simplicity and reliability of the EVM and the completeness of development tools, but also because the developer community and the scale of precipitated assets of the EVM are far ahead. EVM compatible, obtaining developers, users, capital and other resources from the Ethereum ecosystem, is a shortcut to the end of the PMF point for any chain/rollup.

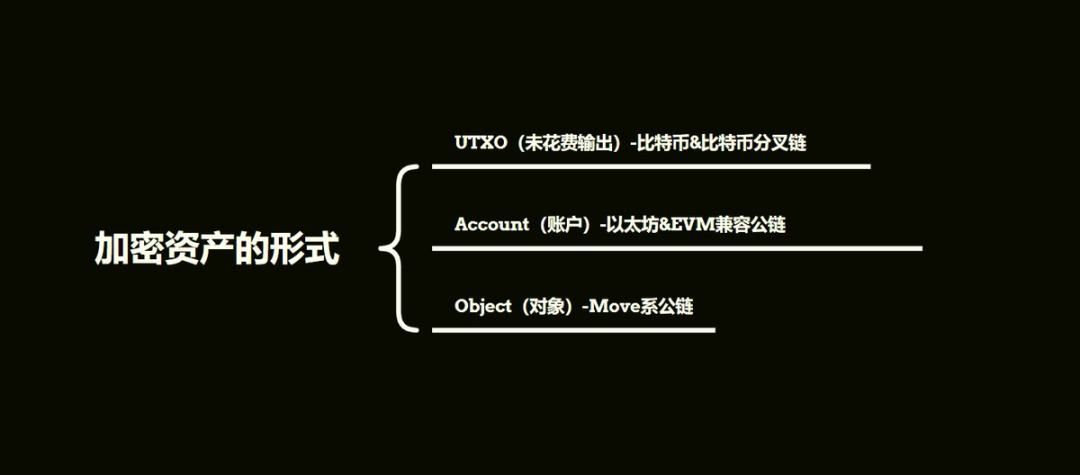

But the EVM is far from perfect, and its state data accounts mechanism, serial state data processing, and the VM characteristics of high-performance public chains have a sense of comparing a 19th-century ironclad ship with a 21st-century destroyer.

After the Cancun upgrade was completed, despite the mainstream Rollup L2

Author: NingNing

In the post-Cancun upgrade era, Ethereum equivalence is no longer innately correct.

At the heart of Ethereum equivalence is EVM compatibility. The reason why EVM compatibility is important is not only because of the simplicity and reliability of the EVM and the completeness of development tools, but also because the developer community and the scale of precipitated assets of the EVM are far ahead. EVM compatible, obtaining developers, users, capital and other resources from the Ethereum ecosystem, is a shortcut to the end of the PMF point for any chain/rollup.

But the EVM is far from perfect, and its state data accounts mechanism, serial state data processing, and the VM characteristics of high-performance public chains have a sense of comparing a 19th-century ironclad ship with a 21st-century destroyer.

After the completion of the Cancun upgrade, although the gas fee of the mainstream Rollup L2 has dropped by two orders of magnitude, the explosion of the Ethereum L2 ecosystem expected by the market has not come as expected, and we have ushered in the strong rise of high-performance public chain ecosystems such as Solana and Sui. This has led some keen minds in the encryption industry to reflect on whether the universal Rollup L2 scaling scheme with the ultimate goal of pursuing the full equivalence of Ethereum is going in the wrong direction.

At present, the parallel scaling scheme has three main shortcomings: EVM compatibility and consistency of the underlying mechanism, which makes the Ethereum Mainnet highly homogeneous with the Dapps in the Ethereum general L2 ecosystem; The L1-L2-L3 hub-and-spoke network structure also deprives Dapp developers of their sovereignty to a considerable extent; The 1+1+1+1+1+*+n linear scalability enhancement that crowd long L2 achieves has a clumsy feel to mechanical stacked Lego.

Therefore, there must be both parallel and vertical expansion schemes. Perhaps, it's time to try to introduce the transaction parallel processing capabilities of high-performance public chain VMs to the Ethereum ecosystem to create some chaos and uncertainty. Recently, parallel EVM projects Monad, Movement, and Lumio (Pontem) have officially announced a new round of financing led and participated by top encryption VC.

Monad, Movement Needless to say, long very well-known. Let's focus on the more low-key Lumio.

Lumio is a parallel EVM project developed by the Pontem team, which is positioned as Ethereum's altVM layer, a VM abstraction protocol that supports longest VMs such as Move, SVM, and WASM. This altVM layer supports out-of-the-box support that allows non-EVM ecosystem teams to "copy-paste" their code on Ethereum with minimal modifications, and only needs to maintain a codebase that minimizes technical debt.

The Pontem team is a team with strong engineering capabilities, and has been deeply involved in the Move high-performance public chain ecosystem since the Diem period. The team has now developed two mature products in the Aptos ecosystem: the Liquidswap AMM and the Pontem Wallet. These two products have an average of ~10,000 active addresses per day. Among them, Liquidswap has a cumulative Tx of 8 million, 700,000 unique Addresses and a daily volume of ~$2 million.

To briefly summarize the history of Pontem, it is a process of Wallet Optimal DEX, DEX Optimal and Parallel EVM.

The Pontem team has a wealth of experience in application development, so the architecture of Lumio was designed with a strong focus on protecting the sovereignty of developers and providing them with the highest possible degree of freedom.

Lumio's design goal is to support any chain and any VM, helping developers break free from the shackles of the product supply chain. VM-level modularity allows developers to choose their favorite VMS (SVM, EVM, MoveVM) to deploy their favorite L2 and L1, such as Optimism and Solana, on Lumio without compromising performance and interoperability.

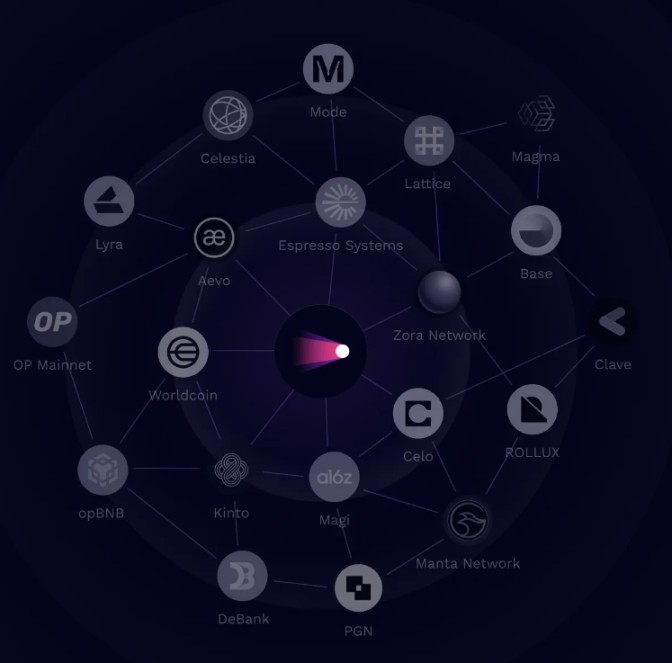

Lumio integrates basic components such as the OP Stack, Arbitrum Orbits' shared sequencer, and cross-chain bridges to achieve shared state and unified liquidity between Dapps on Lumio and mainstream L2.

Shared state and unified liquidity between L1 ecosystems such as Lumio and Solana are achieved through cross-VM calls. As a next step, the Pontem team plans to support Lumio's shared state and unified liquidity with other L1 ecosystems such as Bitcoin and Ton.

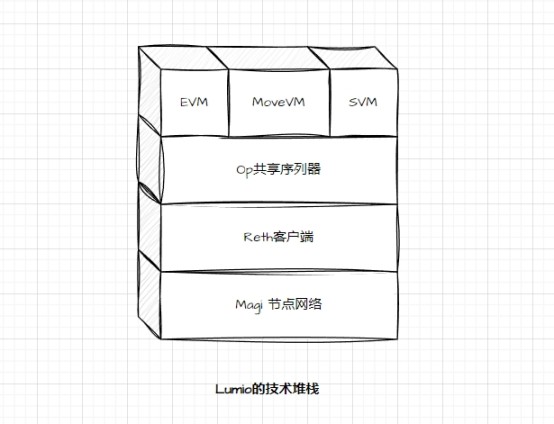

To achieve the above Lumio protocol design goals, Pontem heavily reused components of the OP Stack, especially its RUST instance. Lumio's technology stack consists of the Magi Node Network + Rust language Ethereum client Reth+OP Stack shared sequencer + altVM layer developed by A16Z.

Such a technology stack design can take full advantage of the high performance and security features of parallel EVMs such as SVMs and MoveVMs, while maximizing compatibility with EVMs and UX (user interaction) consistency. The first Mainnet iteration of Lumio, SuperLumio, can also be regarded as an OP superchain.

This makes Lumio naturally have a strong relationship with other OP superchain projects, such as OP Mainnet, Base, Aevo, Worldcoin, Redstone, Mode, and other rollups, to form a robust, prosperous and long L2 ecosystem.

One thing to say, compared to Monad and Movement, Lumio's parallel EVM implementation is a "glue-like" engineering thinking solution with the advantages of fast availability, developer learning curve friendliness, and stability. Although it does not have as high a concentration of new technology primitives as the first two solutions, it is still an excellent and novel Ethereum scalability L2 solution.

Finally, to add details about Pontem's latest funding round: In January '24, Pontem announced a $6 million funding round co-led by Lightspeed Faction (Faction) and Lightspeed Venture Partners. The funding also attracted participation from companies such as Pantera Capital, Aptos Foundation, Wintermute, Altonomy, Shima Capital, and Kraken Ventures.

- Reward

- like

- 1

- Share

Delphi Digital: Exploring Shared Provers, a New Territory of Modularity

Original compilation: Luffy, Foresight News

Modular theory is generally considered to consist of four layers: DA (Data Availability), Consensus, Execution, and Settlement. However, a new layer, the shared prover, may be integrated into the modular theory.

Could it be the missing piece of efficient, scalable validation? The shared prover, proof aggregation, and prover markets are changing the landscape of zk-SNARKs. You can learn everything you need to know in our latest report.

Below is a summary 👇 of the key takeaways from the report

A brief review of zk Rollup

The zk Rollup solution can scale Ethereum‘s transaction size, moving transactions off-chain for faster processing, while enabling hard determinism on top of Ethereum and through zk

Original by Delphi Digital

Original compilation: Luffy, Foresight News

Modular theory is generally considered to consist of four layers: DA (Data Availability), Consensus, Execution, and Settlement. However, a new layer, the shared prover, may be integrated into the modular theory.

Could it be the missing piece of efficient, scalable validation? The shared prover, proof aggregation, and prover markets are changing the landscape of zk-SNARKs. You can learn everything you need to know in our latest report.

Below is a summary 👇 of the key takeaways from the report

Brief review of zk Rollup

The zk Rollup solution can scale Ethereum's transaction size, moving transactions off-chain for faster processing, while enabling hard determinism on top of Ethereum and verifying with zk proofs (zk-SNARKs).

zk proof: fast verification, slow generation

While zk proofs are powerful in terms of privacy and scaling, creating proofs on Ethereum can be costly and slow.

The high cost of attestation limits zk apps. New approaches such as attestation aggregation and prover marketplaces aim to address these limitations.

Protender Supply Chain

Shared sequencers provide high throughput for transactions across Blockchain. However, they don't actually prove anything. They may be integrated with a shared prover network in the future to delegate this task.

Today, rollups face the challenge of expensive, separate zk-SNARKs submissions.

The Proof Network provides a solution: a unified marketplace where various ZK applications can outsource proof generation to dedicated attestation service providers, increasing costs and efficiency.

Shared attestators can greatly improve the situation for applications that require zk-proof support but lack in-house zkVM or circuit development resources.

Currently, Rollups submit separate zk proofs, resulting in high gas costs during peak hours.

The goal of the prover network now is to outsource the generation of proofs to specialized hardware providers in order to increase efficiency.

In a network with longest rollups and connected to a prover network, the transaction lifecycle works as follows:

- Rollup submits an attestation request.

- The matching mechanism selects a prover.

- The certifier satisfies the request.

- Aggregate proofs.

- The prover submits the final attestation to L1 for verification.

Allocate the cost of validation

Proof Singularity refers to a variety of techniques designed to drop on-chain proof of validation costs.

Proof aggregation is one of these techniques, which compresses longest valid proofs into a single proof that verifies all proofs.

This "batch validation" can drop gas costs compared to verifying each proof individually.

zk App Prover Cost

The high verification cost and proof time of ZK applications is ultimately passed on to the user.

Over the past few years, zk applications (mostly Rollups) have spent nearly $30 million in gas to validate and publish proofs on the on-chain.

Proof aggregation protocol profile

Nebra UPA

Nebra UPA lets zk apps bundle long proofs to drop the cost of verification, and they claim to support about 10 proofs per second on Testnet. Their certifiers are currently centralized, but plan to implement them later without the need for proof of permission.

They have a forced inclusion mechanism similar to the existing L2 escape pods. If the prover reviews or latency the proof, the zk application can bypass the prover and enforce the proof settlement on L1.

Aligned Layer

Aligned Layer is Ethereum's universal zk verification layer secured by EigenLayer AVS. Restakers provides users with soft finality through proof aggregation and single Ethereum commits. The default DA is EigenDA, but you can also choose other DA layers, such as Celestia or Avail.

AggLayer

Polygon's AggLayer is a neutral infrastructure for secure cross-chain interoperativity. It aims to unify independent Blockchain networks under a single cross-chain bridge, facilitating interoperability without compromising Blockchain sovereignty.

The system is designed to aggregate the proofs in all connected rollups and then submit a unique proof that contains the Merkle tree for each individual proof submitted.

- It does not require a specific Virtual Machine or execution environment

- Blockchain is free to choose its own gas Token

- It does not need to be subject to co-governance.

Under the hood, the infrastructure that brings all of this together is the LxLy cross-chain bridges, which standardizes a common cross-chain messaging protocol so that Rollups can communicate with each other and with Ethereum while maintaining sovereignty.

A brief explanation 👇 of how LxLy works

- Each chain tracks withdrawal transfers in a Merkle tree (exit tree).

- All exit trees are merged into a global exit tree, which is shared cross-chain

- Updated local and global trees to allow validation and net withdrawal calculations.

In addition, Agglayer has a shared cross-chain bridge between connected rollups, simplifying the flow of assets between L1 and L2. Assets are collateralized in an L1 contract without wrapping or locking/minting.

Traditionally, frameworks have relied on a single internal prover, risking censorship and liveness issues. A network of provers may start in a centralized manner and gradually Decentralization over time.

Decentralization of the prover market is still an open question, but some approaches are being explored:

- Proof Competition: The fastest prover wins, improving efficiency but wasting computation (costs passed on to users).

- Proof Mining: Similar to PoW Mining, random numbers are used to prevent winner-take-all (computational waste still exists). Hardware acceleration in SNARK ASICs is expected to drop costs.

- Reward

- like

- 1

- Share

Blockchain Interoperability 2.0 Moment: Chain Explosion vs. Chain Abstraction

Especially recently, with the improvement of modular public chains and RaaS, the rapid development of "scene chains" has been promoted, such as DePIN, AI or financial applications need an independent Blockchain network, and many long financial or comprehensive institutions also need to issuance their own chains (HashKey Chain and Base).

In addition, the second layer of Bitcoin has also been intensively launched in the past two months, such as Citrea, BOB, Bitlayer, Merlin Chain, etc. Finally, there is the perennial topic of performance, also driven by parallelized Virtual Machines (and Parallel EVMs), such as Monad, MegaETH, Artela

Although this may be an exaggeration, the speed of application innovation may not be as fast as the addition of public chains.

Especially recently, with the improvement of modular public chains and RaaS, the rapid development of "scene chains" has been promoted, such as DePIN, AI or financial applications need an independent Blockchain network, and many long financial or comprehensive institutions also need to issuance their own chains (HashKey Chain and Base).

In addition, the second layer of Bitcoin has also been intensively launched in the past two months, such as Citrea, BOB, Bitlayer, Merlin Chain, etc. Finally, there is the eternal topic of "performance", which is also driven by parallelized virtual machines (and parallel EVMs), such as Monad, MegaETH, Artela, etc.

For the average user, managing assets and applications on longest chains has become increasingly painful, not to mention leaving some gas (transaction fees) on each chain in case of emergency.

These problems have been solved by the popularity of "cross-chain bridges" over the past few years, and some of the Liquidity problems are sometimes categorized under the topic of "interoperability". But in the end, how to bring this liquidity together, or how to tie it all together, is a milestone.

Hence the birth of this new concept and narrative "chain abstraction", which can also be seen as "interoperability 2.0" or the ultimate form of such products.

Three scenarios

Because of these experience issues, Blockchain interoperability is becoming increasingly important. However, the purpose of users is not to use "cross-chain bridges", but to achieve more specific needs, such as trading specific assets or using certain applications.

In scenarios with only a few chains, users can barely manage cross-chain bridges and longing chain assets on their own. However, with the competition of such long chains in the future, as well as the decentralization of applications and Liquidity, it is completely unrealistic for users to manage these assets by themselves. It's not uncommon to hear feedback from the community, "I don't remember stake any assets on which chains and in which protocol."

Users don't want to know what a "chain" is, they just want to know what it can be used for. Therefore, the "demand" should be what the user needs to know, and hiding the "chain" under the demand is the cognition of a normal user.

It is precisely because the cross-chain bridges cannot solve the needs of users to manage assets and directly use applications that the concept of chain abstraction is proposed as another important node under the topic of "interoperability".

There are already many teams focusing on "chain abstraction" and providing solutions, but on the whole, each team has similar modules and architectures, but their respective focuses are also very different, and can be divided into at least these three most representative directions: signature networks, common account layers, and cross-chain bridge aggregation.

In fact, it is also easy to understand that for the chain abstraction scheme, users are usually required to have a unified account, this account and the associated account can submit transactions on longest on-chains, while solving problems such as gas payment and cross-chain information communication. In addition to the above-mentioned commonalities, these solutions focus on different individual modules due to their own characteristics.

NEAR focuses on building a Decentralization Network with MPC Nodes to achieve longer chain signatures, while Particle focuses more on the EVM ecosystem, first supporting the public chain ecology that is currently more widely based on the EVM technology stack, while other solutions like Polygon and Optimism focus more on unified cross-chain bridges, more focused on their own RaaS ecosystem, and only serve L2 with CDK or OP Stack.

Signature Network: NEAR

The signature network solution was proposed by NEAR and is called "Chain Signatures". The core of this technology is to allow addresses generated on the NEAR on-chain to become the user's main account, while accounts and transactions on other chains are signed through a Decentralization Longer Computation (MPC) network and submitted to the target on-chain.

In addition, NEAR has launched a module called Multichain Gas Relayer (long chain gas Relay). The main function of this module is to pay the gas fee of the transaction, which solves the problem that users need to hold the native tokens of each on-chain when conducting cross-chain transactions. Currently, this feature supports paying for gas using NEP-141 tokens on NEAR or NEAR, and does not yet support broader gas abstraction.

The fundamental reason for this design is that NEAR is not an EVM-compatible chain, but as we all know, the mainstream of the current market is still the EVM isomorphic chain, and the number is long long. Therefore, interoperability with the EVM isomorphic chain can only be achieved through the MPC network.

As a result, there are some experiential issues:

- Migration cost is large: For users of the Ethereum ecosystem, it is not possible to migrate directly (such as using MetaMask) to the NEAR ecosystem, or need to create a new account through NEAR.

- The confirmation transaction process is longer: Because the EVM multichain wallet created through NEAR is EOA (that is, a wallet generated by public and private keys), for these cross-chain processes that require longing transactions (including at least authorization + transactions) to queue and sign in parallel, users need to wait for the confirmation process for a long time. And because it is separated and longest, all the gas it consumes cannot be optimized.

From the perspective of Token Utility, NEAR's native Token will become the gas Token of the entire chain abstraction process, and users need to consume NEAR to pay all gas costs in the entire chain abstraction process.

Universal accounts: Particle Network

Particle Network's solution, on the other hand, focuses more on the accounts themselves, scheduling other on-chain states and assets through an independent blockchain network. To put it more bluntly, users only need to use the Address of Particle Network to access the assets and applications of all chains, and Particle calls this Address Universal Account.

As for the relay of information, that is, the transmission of messages across different chains, Particle's L1 listens to the execution of the UserOps of the external chain through the Relayer Node on its own on-chain, but because the underlying layer is still based on EVM, if you want to support the address of the non-EVM isomorphic chain, you may need other modules to support, such as the MPC network similar to NEAR.

So this is a big difference, unlike NEAR, the design of Particle Network is to put EVM in the highest priority, natively an EVM address, access to any chain and application of the EVM ecosystem, or wallet, etc., will be quite easy.

From a user's point of view, Particle Network's EVM-first solution allows users to easily migrate the accounts created in the EVM ecosystem before, that is, to add a network in MetaMask, which is as simple as the process of adding Optimism or Arbitrum networks at that time.

Take a scenario that heavy or Web 2.5 users will have a strong perception as an example: USDT is distributed on several on-chains, such as 100 USDT on chain A, 100 USDT on chain B, and 100 USDT on chain C, when users want to use these assets to buy assets on chain D, it will be very troublesome. Although these USDT belong entirely to users, the user experience is not convenient to implement, because these assets are play people for suckers. If all these USDT are transported to one on-chain, it is not only a matter of finding cross-chain bridges and waiting time, but also preparing gas for different chains. With the Universal Account provided by Particle L1, users can collect the purchasing power distributed on different on-chains, buy assets of any chain with one click, and can choose any token as Gas. The underlying operating mechanism can be referred to the following figure.

In addition, the biggest difference between the Particle solution and NEAR is that the granularity of transactions is different, and batch signatures and transactions can also be achieved through aggregation. That is, users can bundle longest transactions together, which not only saves the number and time of user signatures, but also saves gas involved in complex transaction scenarios.

Particle has designed long consumption and usage scenarios for its Token $PARTI. As an ordinary user, the most direct thing is to use the gas Token as a Universal Account to complete any Blockchain transaction, and if there is no $PARTI, you can also choose other Token to pay on your behalf (but no matter what Token you use to pay for gas, it will consume $PARTI). For the entire ecosystem, Particle L1 has 5 Node roles (refer to the figure below), which can become a Node through stake $PARTI and participate in network Consensus and transactions to obtain more long rewards. In addition, $PARTI Token can also act as LP Token within the Particle Network, participate in cross-chain atomic swap and earn transaction income.

Cross-chain bridges aggregation: Polygon AggLayer

Two typical schemes for cross-chain bridge aggregation are Polygon AggLayer and Optimism's Superchain. They are also all architectures designed with the Ethereum ecosystem first.

Compared with traditional cross-chain bridges, AggLayer hopes to unify the standards of cross-chain bridge contracts, so that there is no need for independent smart contracts between each chain and Ethereum. So in this scheme, the Ethereum Mainnet is the center of everything, and then the cross-chain information of all chains is aggregated through a single zk-SNARKs.

But the problem is that other chains will not necessarily accept this unified liquidity cross-chain bridge contract, which will bring some resistance to access the new public chain, unless this solution can be accepted by all other public links, or become a broad industry standard. If you look at it from another angle, AggLayer is actually an extra feature for teams that have adopted the Polygon CDK development chain, so those who don't use the CDK won't come with this feature.

Optimism's Superchain is similar, they will focus on the interoperability between Ethereum Layer 2 first, after all, there are already some teams using the OP Stack to develop more long layer 2 networks, and they can achieve interoperability in this way, but more importantly, how to expand to a wider range of other public chain networks.

Therefore, in terms of user experience, AggLayer and Superchain can also be easily migrated from MetaMask because they are bound to the EVM ecosystem, but they cannot be connected to the ecosystem outside the EVM.

Summary

Although these schemes differ in focus, they share the same goal: to provide users with a simple and intuitive way to manage longest chain assets and applications in a rapidly expanding world of Blockchain networks. Each team is grappling with how to keep operations simple and clear for users in a longest chain environment.

From the perspective of the three schemes, NEAR's signature network takes the NEAR network as the core, and designs a decentralization MPC network to implement cross-chain signatures. Particle Network's universal accounts focus on enhancing interoperability through the powerful ecosystem of EVM, while accessing longest other public chain ecosystems. Polygon AggLayer, on the other hand, focuses on optimizing interoperability within the Ethereum ecosystem by aggregating cross-chain bridges. Although these solutions have different technical implementations and application focuses, they all aim to improve the convenience and drop complexity of user cross-chain operation.

But I think in the end, these technology choices will end up in the same way. Because they all work towards the same end goal – to improve the user-friendliness and interoperability of the Blockchain ecosystem. As technology evolves and the industry becomes more integrated, we may see more long collaboration and convergence, and the lines between approaches may blur. Therefore, it is more important not only to choose the technology and narrative, but also to land as soon as possible and let users perceive this new experience of full-chain aggregation.

References:

- Reward

- like

- Comment

- Share

Grayscale Report: Bitcoin Layer 2 Frontier Technologies to Watch Out

Bitcoin‘s Rollups technology

Michael Zhao, an analyst at Grayscale, noted that the Bitcoin development space is experiencing a "renaissance" with Layer

In the Crypto Assets space, Bitcoin's technological advancements have been a key driver of the industry's development. Grayscale, a leader in encryption asset management, recently highlighted in its investor report the latest advancements in Bitcoin layer 2 (Layer 2) technologies, including BitVM, Spiderchains, and Taproot Assets, heralding a new era of Bitcoin applications.

Bitcoin's Rollups Technology**

Michael Zhao, an analyst at Grayscale, noted that the Bitcoin development space is experiencing a "renaissance", with the development of Layer 2 technology being particularly eye-catching. Not only do these technologies have the potential to bring new use cases to Bitcoin, but they are also likely to spark more long demand for BTC.

Rollups technology on Bitcoin, specifically BitVM proposed by Robin Linus, is considered one of Bitcoin's "most anticipated" next-generation applications. BitVM, as a new computing model, is able to verify computations on Bitcoin, introducing Ethereum-like smart contracts functionality to the network. Currently, optimistic Bitcoin rollups is one of the main applications of BitVM, which allows users to process transactions in batches in a off-chain environment and then Settlement them back to Bitcoin, which greatly improves transaction efficiency and drop costs.

Grayscale also looked at the Spiderchains technology, developed by Botanix Labs. Spiderchains are Layer 2 chains secured by Bitcoin (BTC) stake in the Decentralization multisignature Wallet. The innovation of this technology is that it allows Bitcoin assets to be secured on a layer 2 on-chain while maintaining the Decentralization nature of the Bitcoin network.

Bitcoin's ** re-staking technology

In addition, the Babylon project opens up new opportunities in the Bitcoin stake sector through its BTC re-stake technology. Enabling BTC holders to stake their coins through other Blockchain networks such as ETH or Sonana through this technology and earn yield from them provides Bitcoin holders with new ways to add value.

The Taproot Assets project mentioned in the Grayscale report seeks to bring tokenization technology, especially stablecoins, into Bitcoin's Lighting Network, one of Bitcoin's most popular layer-2 solutions.

Grayscale believes that although Bitcoin's smart contracts ecosystem is not fully developed, its potential market size is huge. Currently, about 17% of Ethereum's total market capitalization ($360 billion) is currently used in applications, while the value locked in Bitcoin dapps is only 0.2% of its total market capitalization ($1.2 trillion). Grayscale predicts that Bitcoin's market value is expected to lead to higher market value over time if the current development wave can drive broader adoption of these use cases.

This report provides investors with a valuable perspective on the evolution of Bitcoin technology and highlights the potential of Layer 2 technology to drive Bitcoin adoption and market demand. As these technologies mature and apply, the future of the Bitcoin ecosystem will be more longing and vibrant.

Conclusion:

Grayscale's report sheds light on the exciting prospects for Bitcoin's layer-2 technology developments that have the potential to dramatically expand Bitcoin's functionality and applications. As innovative solutions such as BitVM, Spiderchains, and Taproot Assets continue to mature, the Bitcoin network's smart contracts capabilities, transaction efficiency, and user engagement are expected to improve significantly.

In particular, the development of these technologies can not only bring new market opportunities for Bitcoin, but also may trigger a new round of demand for BTC, thereby providing investors with new value-added potential. Although Bitcoin's smart contracts ecosystem is still in its infancy, its untapped market potential portends a huge rise short.

With the continuous progress and application of Bitcoin layer 2 technology, we have reason to believe that Bitcoin will continue to be a leading asset in the Crypto Assets field and lead the industry into a new stage of development. For investors, it's time to take a deep dive into these cutting-edge technologies and consider their impact on Bitcoin's long-term value. As technology continues to evolve, we expect the Bitcoin ecosystem to usher in a more prosperous and longest future.

- Reward

- like

- Comment

- Share

Bloomberg: VC removes to "professor coins", does Web3 need an academic background?

Original compilation: Luffy, Foresight News

As Crypto Assets industry fundraising takes off again, venture capitalists are turning back to encryption startups founded by professors.

Companies such as Sahara, CheckSig, and NEBRA were all founded by academics and have raised new funding in the past two months. Among the projects known as "professor coins" in the industry, two stand out. Founded by former associate professor Sreeram Kannan at the University of Washington, EigenLayer raised $100 million from Andreessen Horowitz in February of this year, while Babylon, founded by Stanford professor David Tse, won it last December

Original authors: Hannah Miller, Muyao Shen

Original compilation: Luffy, Foresight News

As Crypto Assets industry fundraising takes off again, venture capitalists are turning back to encryption startups founded by professors.

Companies such as Sahara, CheckSig, and NEBRA were all founded by academics and have raised new funding in the past two months. Among the projects known as "professor coins" in the industry, two stand out. EigenLayer, founded by former associate professor Sreeram Kannan at the University of Washington, raised $100 million from Andreessen Horowitz in February, while Babylon, founded by Stanford professor David Tse, raised $18 million in December. Both projects are focused on a growing area of Crypto Assets, known as "staking," which allows new projects and blockchains to get a head start by borrowing Ethereum or Bitcoin's secure infrastructure and resources.

Riad Wahby, a professor of engineering at Carnegie Mellon University and CEO of Crypto Assets startup Cubist, said some of the techniques people use to generate yield during the Crypto Assets cycle "come from David and Sreeram's research." "They've worked on a lot of long of these kinds of re stake techniques. I mean, it's kind of like their brainchild. I think these kinds of technologies, which are getting more and more long, will come from research."

Kannan spent two years as a postdoc at the University of California, Berkeley and Stanford University, where he worked with TSE, according to his bio on the University of Washington's Information Theory Lab webpage. According to computer science literature website DBLP, the two collaborated on 23 academic papers between 2015 and 2023, publishing numerous articles on Blockchain and the concepts on which their respective startups depend. Neither Kannan nor Tse responded to requests for comment.

Re-staking favored by capital

Global venture capital activity for Crypto Assets startups, source: PitchBook

Kate Laurence, CEO of Bloccelerate VC, said her VC firm often sees an academic background as a disadvantage when deciding which founder to support. "Professors tend to focus on academics and theory rather than practical and commercial applications," she said.

But Kannan's work on staking and his close relationship with Tse led Bloccelerate to invest first in EigenLayer and then in Babylon. "They're working together to solve the same problem, but EigenLayer solves a different market," she said.

The process of "staking" is a reference to how Ethereum works. In Ethereum, Tokens are "staked" into the network to help validate transactions on the Blockchain. For new projects and blockchains running the same mechanism, setting up your own stake system can be too slow and costly due to a lack of user activity and funding. Re-staking allows new players to borrow Ethereum's staking power to get a head start.

Babylon takes a similar approach but focuses on Bitcoin. This task is more complicated because Bitcoin uses a different mechanism (PoW) to verify transactions. If successful, the Babylon platform will also address a long-standing problem for Bitcoin holders: a lack of yield.

Vance Spencer's company, Framework Ventures, which has also invested in Babylon, said it makes sense that such advanced technological achievements came from universities. "There are so few people who can build Blockchain," he said, "and they are likely to come from these research institutions."

What are the controversies?

Emin Gun Sirer, a former associate professor of computer science at Cornell University and CEO of Ava Labs, which developed the Avalanche blockchain, said the road ahead for professor-led encryption projects is often not smooth, with longest projects failing.

"They're playing a game of technological innovation," Sirer said, "rather than product-market fit."

DefiLlama said that while the EigenLayer platform attracted more than $15 billion in encryption assets, it also suffered setbacks, with critics arguing that it was a misunderstanding of the broader encryption asset market.

Although Kannan told Bloomberg in February that they had no plans to issuance Token, EigenLayer released a issuance plan for the Eigen Token in April and began distributing it on Friday. Eigen's total supply is around 1.67 billion Tokens, more than half of which are designated for investors and early contributors, and the plan caused a backlash from the community after it was revealed. This distribution has sparked criticism of the pockets of the EigenLayer team and initial supporters, as well as concerns among users about potential selling pressure. The decision to make the Token non-transferable at issuance also disappointed some early adopters who had invested heavily in EigenLayer.

The Eigen Foundation, which is responsible for the Token program, said in a blog post that by restricting Token transfers, it could have more long time to improve the Decentralization of the project, as well as enhance key features related to Token.

The total value of Crypto Assets on EigenLayer has exceeded $15 billion, source: DefiLlama

Ayesha Kiani, chief operating officer of Crypto Assets Hedging fund MNNC Group and an adjunct professor at New York University, rejects criticism related to EigenLayer, arguing that the startup is more than just another "get-rich-quick scam." She said Kannan and Tse are working to improve the encryption industry.

"The industry has criticized them for their lack of decentralization, or just a means of making money," she said, "and in this industry, we're now used to free incentives, and if everything doesn't go well, we basically have to abandon the program."

- Reward

- like

- Comment

- Share

Merlin Chain talks about ABCDE and Water Drop Capital: What are the opportunities for entrepreneurs in the third wave of Bitcoin ecology?

Jeff: Hello everyone, this is a Chinese VC conversation, first of all, please briefly introduce yourself.

BMAN: I‘m BMAN from ABCDE Capital, I have 12 years of experience in the encryption space and have been through longest market cycles. We have a total of 400 million funds, and we have also invested in projects in the long Bitcoin ecosystem such as Merlin Chain, UniSat, and Babylon. It‘s a pleasure to share your views on the Bitcoin ecosystem here, thank you.

Yushan: Hello everyone, I‘m Shuidi Capital Dashan. I joined the encryption world in 2013 and co-founded Waterdrop Capital in 2017 with two other partners, and since 2021, we have been investing in the Bitcoin ecosystem and have also participated with ABCDE

The following is the full transcript of the conversation, organized from the live recording.

Jeff: Hello everyone, this is a Chinese VC conversation, first of all, please briefly introduce yourself.

BMAN: I'm BMAN from ABCDE Capital, I have 12 years of experience in the encryption space and have been through longest market cycles. We have a total of 400 million funds, and we have also invested in projects in the long Bitcoin ecosystem such as Merlin Chain, UniSat, and Babylon. It's a pleasure to share your views on the Bitcoin ecosystem here, thank you.

Yushan: Hello everyone, I'm Shuidi Capital Dashan. I joined the encryption world in 2013 and co-founded Waterdrop Capital in 2017 with two other partners, and since 2021, we have been investing in the Bitcoin ecosystem and participating in the financing of Merlin Chain with ABCDE. We are also currently looking for innovative projects within the Bitcoin ecosystem, and we are happy to share them with you soon, thank you.

An opportunity to invest in the Bitcoin ecosystem

Jeff: Let's go back to the beginning, when did you start investing in Bitcoin ecological projects, and what was the first project you invested in?

BMAN: First of all, of course, Merlin. The reason we want to invest in the Bitcoin ecosystem is that the emergence of Ordinals last March made us realize that Bitcoin is much more than just digital gold, it has become an ecology, which is an important turning point. Before that, we worked in the encryption world for 12 years, but we couldn't do anything with Bitcoin.

But since last year, we have been able to engrave assets and even create ecological projects on Bitcoin. Therefore, we felt that we needed to invest some of the funds in the Bitcoin ecosystem, and last September, we held demo days, and it was at that time that Merlin Chain was discovered. I've known Jeff for a long time, and I know that Jeff has been involved in the Bitcoin ecosystem, including the BRC-420 protocol, Bitmap Explorer, and so on. I approached Jeff and talked to him about the need for a Bitcoin Layer 2 that could aggregate all assets together, which is one of the reasons Merlin Chain was born. I think it was a thought-provoking conversation, and that's why we decided to lead Merlin. Merlin is the first ecological project we participated in, and we have successively invested in Babylon, UniSat, Botanix, Arch, etc., and now we have invested more than 50 million US dollars in the Bitcoin ecosystem, which is probably the most long investment in the Asian VC. We will continue to invest in the field in the future, and if you have innovative and bold ideas, please feel free to talk to me.

Yushan: For me, I was a Bitcoin Miner about 10 years ago. One of the more important nodes in the last Bull Market was the Taproot upgrade of Bitcoin in 2021. In the Bull Market of 2021, everyone's attention was all on the Decentralized Finance Summer of the Ethereum ecosystem, and almost no one cared about what happened to Bitcoin. But as Bitcoin Miner, we are well aware that after Bitcoin Taproot upgrade allows new assets to be issuance, some new ideas will inevitably emerge in the ecosystem.

Three years ago, we invested in a project called OmniBoat, which was our first investment in the Bitcoin ecosystem. Unfortunately, Tether decided to stop supporting longest chain assets, so we restarted looking for other investment opportunities in the space, including some Bitcoin Layer 1 projects and invested in a Layer 1 game, and discovered Merlin shortly thereafter. Although I have known Jeff for a short time, I know that he has experience related to AI in the Web2 field, and I also feel that what they are doing is very beneficial to the Bitcoin ecosystem, so I chose to invest in Jeff's project later. But Jeff's RCSV project was actually built on Layer 1, and I didn't expect the team to choose to do a Bitcoin Layer 2 later.

Bitcoin Layer1 has the potential to be more innovative long

Jeff: As you know, ABCDE Capital and Waterdrop Capital have invested in very long Bitcoin ecological projects. In addition, Merlin will soon release a Grants program to support more long ecological projects, and we welcome fren with new ideas and intentions to come and talk to us.

Let's go back to Layer 1 first, there are a lot of long Ordinals, BRC-20, and Runes Marketplaces on Layer 1 Bitcoin, but as far as I know, long Layer 1 projects are Fair Launches and are not profitable. My second question is, what are the investment opportunities in Layer 1 today, and do you think it is more difficult to invest in Layer 1 projects than in Layer 2 and other Decentralized Finance protocol?

BMAN: First of all, I think the spirit and charm of the Bitcoin ecosystem has always been in the projects (especially Layer 1 assets) has always been Fair Launch. I think in the next year or two, there will be more and more long innovations in Bitcoin Layer 1, such as OP_CAT. Last month we hosted Bitcoin Day in Hong Kong with the founder of StarkWare, who also talked about BTC Cairo and OP_CAT, where there has always been a small group of people developing around OP_CAT and BVM. This is interesting because StarkWare has always been a builder of the Ethereum ecosystem, but decided to join the Bitcoin ecosystem to participate in the construction of OP_CAT. We can build Bitcoin Layer 1 verification based on OP_CAT, and I also believe that with the blessing of OP_CAT, there will be more long innovations in Bitcoin Layer 1, including the Programmability and verifiability of the Bitcoin network.

Yushan: I very much agree with BMAN's point of view, and I also think that the passage of OP_CAT will be an important turning point for Bitcoin. However, due to the disagreements between the core developers, the Bitcoin Miner, and the community, it will not be easy for the OP_CAT proposal to pass, and we may not see the outcome of the proposal in the next one to two years. In addition, I think PSBT (Partially Signed Bitcon Transactions), MAST (Merkelized Alternative Tree), and other Layer 1 protocols also deserve our attention.

We are also trying to attract other ecosystems, especially Ethereum ecosystem developers, to participate in the Bitcoin community. Looking back at the beginning, the idea of Ethereum actually originated from Bitcoin, and other technologies and ideas such as the Layer 1-Layer 2 challenge mechanism were first discussed in the Bitcoin Forum. This also means that in fact, there are longest new ideas and ideas hidden in Bitcoin code, proposals and forums that we need to discover and promote ourselves. Yesterday I was talking to a veteran Bitcoin core developer who is still working on some deceptively simple but profound code. Therefore, I hope that more and more long developers can participate in this game and bring us more long possibilities.

Traits of Bitcoin entrepreneurs: the best and the only one, and seize the moment

Jeff: What advice do you have for builders of the Bitcoin ecosystem, and what qualities would you like to see in the founders and builders of the ecosystem?

BMAN: That's a great question, and I'm actually the founder of the project myself. I started my own project in 2015 and ABCDE was also a new starting point for me. I think that for a project founder, you need to first discover a track that you can define. ABCDE's mission has always been to invest in the best and only projects, so my advice to founders is to be the best and only one in a track. Merlin Chain has its own token standards, ace projects, the highest TVL and the best community, which is why we led Merlin. For example, BitLayer is the first Bitcoin Layer2 built on BitVM, and Babylon is the first and only Bitcoin-native liquid staking protocol. So, as the founder of a project, you have to look at the market as a whole and discover the track that you can define and be the best and only project in it, which is enough for you to capture more than 80% of the value in this narrative, because the second place is that no one cares at all.

Yushan: First of all, I don't think a good developer is exactly the same as a good founder. As a founder, you have to do much more than just write beautiful code, you also need to think about everything else, from marketing to funding. First of all, the most important thing for a project is timing. I think there will be three waves in the Bitcoin ecosystem.

The first is assets issuance on Layer 1 such as Ordinals, BRC-20, Runes, etc. This was followed by Bitcoin Layer 2, and I recently talked to the founders of the very long Bitcoin Layer 2 projects and found out that they just wanted to be another Merlin, which was not practical because the TVL and other achievements Merlin has now are not replicable. There are currently more than 10 Bitcoin Layer 2 projects in this space, longest of which are different, such as some projects using bitVM technology, others choosing to use longest signatures or sidechains. I think there is no shortage of EVM Layer 2 in the current ecosystem, what we have always lacked is a more native Bitcoin Layer 2, such as Bitcoin Layer 2 based on Lightning Network, Taproot Assets, RGB, UTXO, I think the third boom of the Bitcoin ecosystem will appear in these areas. We're also looking forward to a growing long of founders and hypotheticals joining us, and we'd like to see Merlin Chain and other Bitcoin Layer 2 networks move toward mass adoption as soon as possible.

Lessons learned from investing in the Bitcoin ecosystem

Jeff: Last question, let's talk about mistakes and failures, what are the biggest failures and lessons learned from investing in the Bitcoin ecosystem?

Yushan: Just kidding, our biggest mistake was that if we went back to last year, we would invest longest in Merlin. I think for the Bitcoin ecosystem, we need to cooperate with the mainstream media longest. When we first started to invest in the Bitcoin ecosystem last year, we talked a lot about it long the mainstream media didn't care about it, they thought that Bitcoin Layer 2 was just a copy of the Ethereum and not practical. At the time, we couldn't convince them to believe it, but now we can confidently say that their thinking was completely wrong. Having said that, there are still longer critics of Bitcoin Layer 2 in the market, and effective communication with the media is essential for the entire Bitcoin ecosystem.

BMAN: What I've learned is the need to unite all founders and builders to build the Bitcoin ecosystem. We all know that there is too long fear, uncertainty and doubt (FUD) and vicious competition in this ecosystem, but I think the main theme at this stage should not be competition. In fact, we should all be partners and fellow travelers, because if we can push the ecological value to k billion or even more long, everyone will benefit from it. Therefore, my view is that we need to build together instead of fear, uncertainty and doubt (FUD) each other.

Jeff: Finally, I want to say that when I talked to some media reporters, they told me that the Solana ecosystem has a spirit of building together in small communities, Ethereum has always followed Vitalik's guidance, and when it comes to Bitcoin, people see that assets such as Ordinals, BRC-20, Runes and so on play people for suckers the Bitcoin community. So, I think what we're going to do in the next one to two years is to build together, help each other, and "Make Bitcoin Fun Again" together.

- Reward

- like

- Comment

- Share

Worldcoin fears a "vicious inflation", and the sell-off could last for several months

Original article by Natalia Wu, BlockTempo

Worldcoin, a Crypto Assets project backed by OpenAI CEO Sam Altman, has seen its coin price decline after hitting an all-time high of $11.972 on March 10, despite the official announcement in April that it would launch a Layer 2 that combines finance and identity verification

Original title: "Whale Trader: World Coin Unlocked in July May Fear of "Vicious Inflation", Worldcoin Sell-off May Last Months"

Original article by Natalia Wu, BlockTempo

Worldcoin, a Crypto Assets project backed by OpenAI CEO Sam Altman, has seen its coin price decline after hitting an all-time high of $11.972 on March 10, although it has not seen much improvement after the official announcement in April that it will launch a Layer 2 network that combines finance and identity verification.

Source: TradingView

Whale traders: The world's coins are likely to sell off for months

Xu long swept the iris, and the global users who were able to receive the WLD Airdrop regularly were still quite looking forward to the follow-up performance of the world coin Bull Market, but today (14) they were poured cold water by a Whale trader.

@DefiSquared, the number one trader at Bybit, wrote in X today that Worldcoin could actually be the largest wealth transfer in the entire cycle, but that this wealth transfer did not take place in the form of a universal basic income (UBI) as the official suggested, "but went into the pockets of teams and insiders", and criticized the world coin as a deceptive project that actually "has no real connection to OpenAI".

He pointed out that as WLD unlocks continue to increase, there will soon be vicious inflation and a wave of selling in the coming months.

Worldcoin may now be malignant inflation

In this regard, he sorted out several data that will lead to malignant inflation and analyzed:

-

The current WLD FDV is $60 billion, and its value is depreciating by 0.6% per day as a result of grants issued and applications by operators, most of which are sold almost immediately, according to on-chain analysis.

-

The Worldcoin Foundation just announced that they will sell $200 million worth of tokens to market makers at a discount; This is equivalent to selling an additional 18% of the total circulating supply to counterparties, and the 200 million Tokens are distributed from the "community".

-

On top of that, with just 70 days left before the VC and team unlocks start unlocking, the WLD supply will start to expand at a rate of 4% per day (unlocks + emissions). For insiders looking to cash out $60 billion in FDV, there is non-stop selling pressure of nearly $50 million per day.

WLD will begin unlocking in late July, and WLD daily emissions will increase at a 4% inflation rate. Source: @DefiSquared

Beware of Token Economy with Low Circulating Supply/High FDV Design

@DefiSquared finally warns that Token like WLD was designed from the outset to be a predatory Token economy that favors teams and early investors, and that the manipulative low-Circulating Supply/high-FDV design is straight out of the SBF playbook, and that insiders get straight rich when they hedge locked-in allocations at high valuations through Perptual Futures/OTC; Sadly, retail investors still think they are beating the system and trying to push prices higher.

Sadly, this isn't new to the industry, which helps ensure insiders exit liquidity at dizzying valuations.

Link to original article

- Reward

- like

- Comment

- Share

Solana new star has set off a national coin boom, Pump.fun fairness and risk coexist

Online culture and memes have always played an important role in the encryption market. However, due to the high-risk nature of meme coin, long investors are rarely able to profit from it and are susceptible to huge losses. This situation has led to value investing in the meme market becoming unreliable and over-speculative.

However, meme‘s built-in traffic attribute has long become an indispensable part of the development of public chains. Therefore, how to maintain the fairness of the meme market has become an important issue in this round of Bull Market. As the largest meme launch platform in the Solana ecosystem, Pump.fun has recently attracted a lot of attention from the market. Pump.fun continues the fairness narrative by allowing users to do so at a fraction of the cost (0.02

Original article by Daniel Li, CoinVoice

Online culture and memes have always played an important role in the encryption market. However, due to the high-risk nature of meme coin, long investors are rarely able to profit from it and are susceptible to huge losses. This situation has led to value investing in the meme market becoming unreliable and over-speculative.

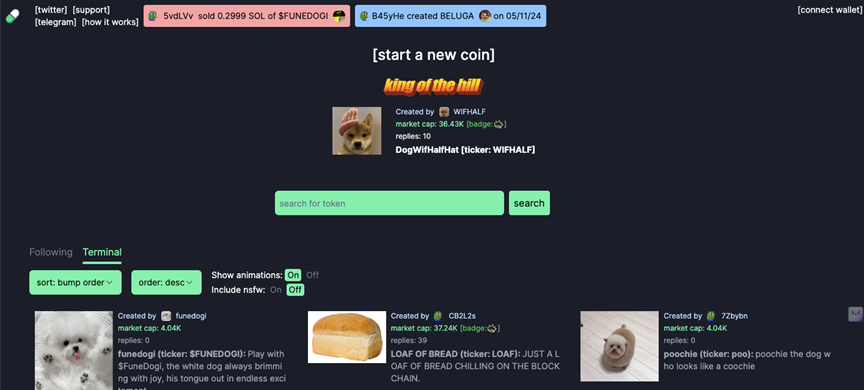

However, meme's built-in traffic attribute has long become an indispensable part of the development of public chains. Therefore, how to maintain the fairness of the meme market has become an important issue in this round of Bull Market. As the largest meme launch platform in the Solana ecosystem, Pump.fun has recently attracted a lot of attention from the market. Pump.fun continues the fairness narrative by enabling users to deploy and issuance Token at a fraction of the cost (0.02 SOL) without any development experience. Since its launch in January, Pump.fun has issuance more than 460,000 Token. The rise of Pump.fun has also led the meme coin track into a new stage of "coin for all".

What is Pump.fun

Pump.fun is a coin tool and social platform focused on meme coin. It launched on Solana in January 2024 and added support for Ethereum L2 Blast shortly after the Mainnet went live. Pump.fun provides users with an easy and low-cost way to deploy and issuance Token by simplifying the coin process and drop technical thresholds. Users only need to pay 0.02 SOL and can easily use the platform with no development experience required.

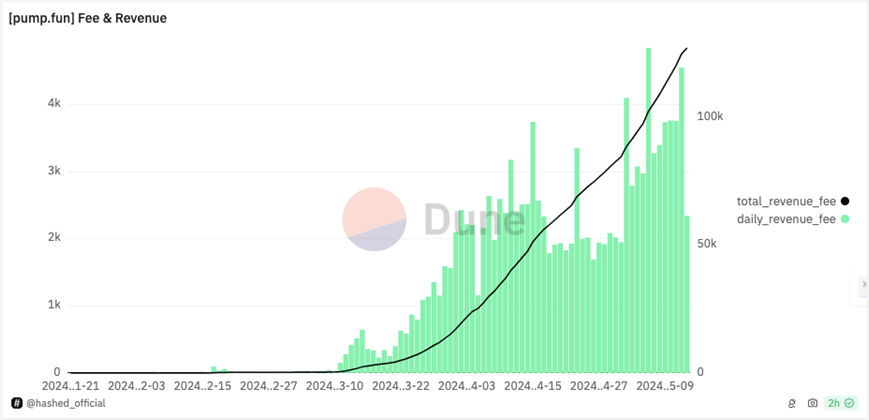

This simplicity and low cost have led to the rapid popularity of Pump.fun in a short period of time, with significant success. Over the past 10 days, Pump.fun's volume has shown a parabolic rise trend, generating a rise of nearly 50% of total revenue. At present, the daily revenue of the platform is still above $450,000, and there is no trend of decay.

Pump.Fun coin process

Users can currently choose to use Blast or Solana. From there, the startup process is very simple, just click "Start a new hard coin" and enter the name, code, description and brand image, and pay 0.02 SOL to start the "fundraising" issuance process of a Token, the whole process is very simple, users do not need to adjust the number of issuance and token ownership and other settings, the requirements for professional knowledge are very low, and ordinary people can also operate.

Once the new coin is created, the new Token will be launched along the bonding curve on the Pump.Fun platform. A bonding curve is a mathematical curve that determines the price of a Token based on the supply. As more long Token are purchased, Token prices are usually pump. Anyone can buy and sell on the platform, and when the total market capitalization of the token reaches $69, 000, the liquidity of the bonding curve will be deposited into Raydium and burned.

When Token's Liquidity is deposited and burned, users can purchase it through Solana DEX Raydium or through their preferred Telegram bot and web application terminal, earning more long Liquidity. Once this is reached, Pump.Fun issuance new coin will look just like any other Token, and by this point, the new coin issuance has succeeded.

Pump.Fun coin features

(1) Extremely low coin cost: Anyone can deploy their own meme Token on Pump.Fun for less than $2.

(2) No seeding Liquidity: Pump.Fun does not need to seed a large amount of Liquidity for a new issuance Token, the system will automatically establish an initial liquidity pool (about $60,000) on the DEX.

(3) Automated process: Once the market capitalization of the new Token reaches $60,000, the system will automatically inject all the purchased funds into the liquidity pool and list trading on Rayium Swap.

(4) Waiver of the right to mint coin: The creator gives up the right to mint coin when deploying the Token, and all Token are issuance at the time of creation.

(5) Fair distribution: Since the creator cannot reserve Tokens, all Tokens enter the open market at the time of creation, and there is no hidden Wallet.

(6) High risk and high return: The price of the meme Token on the Pump.Fun is Fluctuation sharply, and there is a serious PUMP&DUMP phenomenon, which is very risky but may also obtain high returns.

Pump.fun Why is it popular all over the Internet?

With the dramatic increase in interest in online culture and meme coin, many long investors are very keen to launch their own Token, but often lack the technical knowledge needed to create a good Token, so the issuance of meme Token has long been monopolized by institutions with technical expertise and deep capital, making it difficult for ordinary users to participate in it.

In addition, the frequent problems of rat trading, RUG, and scientist rush in the meme market have also made the entire market full of unfriendliness to ordinary investors, and some time ago BOME led the "meme pre-sale fever" model, and only a week later, it became a Newbie segment for playing people for suckers of retail investors. For example, after the Avalanche fundraising project Sener raised about 93,000 AVAX (about $4.8 million), the founders transferred a large amount of AVAX away, and the project Token SENDER only opened slightly pump before entering the full sell-off stage.

The lack of transparency and fairness makes the meme market fraught with various risks. However, the hundredfold wealth password has made investors and the community enthusiastic about meme coins. In order to maintain the prosperity of the market, there is an urgent need for a meme coin issuance platform similar to Birdeye, but with a greater focus on fairness. And pump.fun just meets the needs of meme enthusiasts.

In terms of fairness, pump.fun meets the needs of ordinary investors through extremely low coin issuance costs, and at the same time simplifies the entire coin process by productizing memes, making the entire coin process more open and transparent.

The creator automatically relinquishes the right to mint coin when deploying the Token, which also means that the Token of the Pump.fun will not have a nominal project party and manager, so there will be no RUG problems caused by super privileges.

Second, Pump.Fun also improves the fairness of the platform by eliminating creator interference in the coin process. Liquidity on the platform is artificially created and runs on a bonding curve that the platform retains. Once the Pump.Fun Token goes live on Raydium, the Liquidity will automatically burn, locking the AMM Liquidity. This means that even as a project creator, you can't stop this process from happening.

In addition, compared with traditional coin platforms, Pump.fun not only has a fairer coin model, but also combines coin and social attributes, which has become one of its major innovations. When you create a Token on Pump.fun, you need to include an image and a description in addition to the name of the Token yourself, as well as a comment feature. This gives it the ability to communicate the story and style behind it quickly and intuitively. In addition, there is a message board-like feature on the Pump.fun where users can leave messages and communicate with each other.

Due to its fairness, transparency and social attributes, Pump.Fun became popular in the entire encryption industry for a while, and in less than 3 months after its launch, Pump.Fun became the most trafficked Memecoin platform in the Solana ecosystem. According to DeFiLlama, the total amount of fees for Pump.Fun has exceeded $3 million in the past seven days. Notably, Pump.Fun hit an all-time high on May 7 with over $752,000 in daily fees, making it the highest-grossing app in the Solana ecosystem.

Pump.Fun: Fairness and risk coexist

Pump.Fun was originally conceived to maintain fairness in the meme market. As a new project, Pump.Fun has indeed achieved more fairness and transparency than traditional platforms, but in the encryption industry, where the higher the profit, the greater the risk, and some of the rules of the Pump.Fun have also been used by people with intentions to become a tool to play people for suckers others.

Pump.Fun drop coin threshold allows ordinary investors to participate in the coin market, resulting in more than 10,000 coin issued every day, but the vast majority of them are junk coin. For investors, it is not easy to find potential value coins among the longest junk coins, because the information available for reference is very limited, and they can only rely on the social information of the project, such as message boards or token information, to judge their merits.

Unfortunately, these social messages can be easily faked. The average investor tends to be more likely to believe and buy Tokens when they see some well-known people creating or following them. However, they may not realize that these celebrities may have been faked by others with accounts with high followers, creating the illusion of high followers. These people buy a lot of bottom chips early in the token, then wait for users to enter the market blinded by the illusion of high attention, and then quickly sell out. Similarly, some celebrities may use their influence to create new tokens, and then quickly monetize their influence (play people for suckers) through extreme price curves.

For example: TEST is the first meme Token deployed on Pump.Fun, created by the development team. Early buyers took advantage of the tool to buy nearly 50% of the supply, causing prices to pump sharply. But then the holders dump, and the price of TEST fell sharply, resulting in the play people for suckers of retail investors who entered the market after the long. There is also BERT, which was already tenfold within 15 minutes of opening, but then there was also a serious PUMP&DUMP phenomenon that caused the price to big dump.

The fairness of Pump.Fun is to let every user have the opportunity to bet on the table, but the gambling is too large, the user may bet on the right bet may be multiplied hundreds of times in less than a day, but if the bet is wrong, it will become the object of the play people for suckers, compared to the meme coin platform, Pump.Fun feels more like a betting platform, and even American professional poker player Tom Dwan mentioned Pump.fun in a tweet, suggesting that he is interested in Pump.fun's gambling entertainment.

Pump.fun sparked a nationwide coin boom

The popularity of Pump.Fun has also led to a nationwide coin boom, with the Solana network issuance an average of 14,000 new Token per day in the past two weeks, the vast majority of which come from Pump.Fun. Pump.Fun has created 10,000 meme coin per day for six consecutive days, which shows its huge potential in the meme market. In addition, the Base Chain continues to launch more than 2,000 trading pairs longing days. The explosion of one-click coin tools represented by Pump.Fun also indicates that the Meme coin track is about to enter a new stage of "coin for all". At present, in addition to Pump.Fun, there are several popular meme coin platforms.

We.rich

We.Rich is a UGA (User Generated Asset) platform that allows anyone to launch LP-free (No Liquidity Pool) Meme Token with one click. Borrowing from Pump.Fun, We.Rich has added more long features and optimized the user interface. For example, keeping the Token price extremely low during the initial fair issuance phase as well as a limited Mint feature. However, We.Rich is deficient in terms of asset information and lacks social attributes. Although there is still a large gap between the number of issuance and active users compared to Pump.Fun, for the Base chain, which also has a huge meme market, the emergence of this project has added a new competitor for Pump.Fun in the meme coin battleground.

Rug.fun

Rug.fun is another meme coin issuance platform from Base on-chain that is somewhat similar to Pump.fun in terms of model, and anyone can post coin on the platform. However, in terms of rules, Rug.fun is more aggressive and more gambling than Pump.fun.

Rug.fun's coin rules are divided into two phases. The first stage is the creation of Tokens, where anyone can create Tokens in a period that lasts 12 hours. After the deadline, only the top 10 tokens with high liquidity enter the second stage, while the eliminated Tokens will return the purchase funds. The second stage is a competition between the top 10 Tokens, and after 12 hours, only the 1st and 10th Tokens win. Holders of these two Tokens will share the liquidity of all 2nd to 9th place Tokens, and each will receive a 50% share. In addition, each Token purchase generates taxes, which gradually increase over time, and the winner also has the opportunity to share the tax revenue. Token will be eligible to be listed on a DEX exchange.

Friend.tech

Friend.tech is a Decentralization social platform that released the Friend.tech V2 version in March 2024, introducing the Club feature. On Friend.Tech and Club, anyone can create an unmisused and 100% safe Token with the click of a button.

Once the Token is created, it will have a bonding curve feature. This means that there is a correlation between the supply and price of the Token. When supply increases, prices pump, incentivizing people to hold and participate. Since this is a Decentralization Social Platform, the Token created will make the creator and holder take responsibility for social links and be tied to reputation on the Internet and Blockchain. This will give the creator more long responsibility and motivation to ensure the success of the project.

© This article is CoinVoice's high-quality original content, and unauthorized reproduction is prohibited.

- Reward

- like

- Comment

- Share

SignalPlus Macro Analysis (20240514): Data expectations are not optimistic, and inflation may start to Rebound

! [SignalPlus Macro Analysis (20240514): Data Expectations Are Not Optimistic, Inflation May Start to Rebound] (https://piccdn.0daily.com/202405/14062351/u4jjnnij44tgarbt.png!webp)

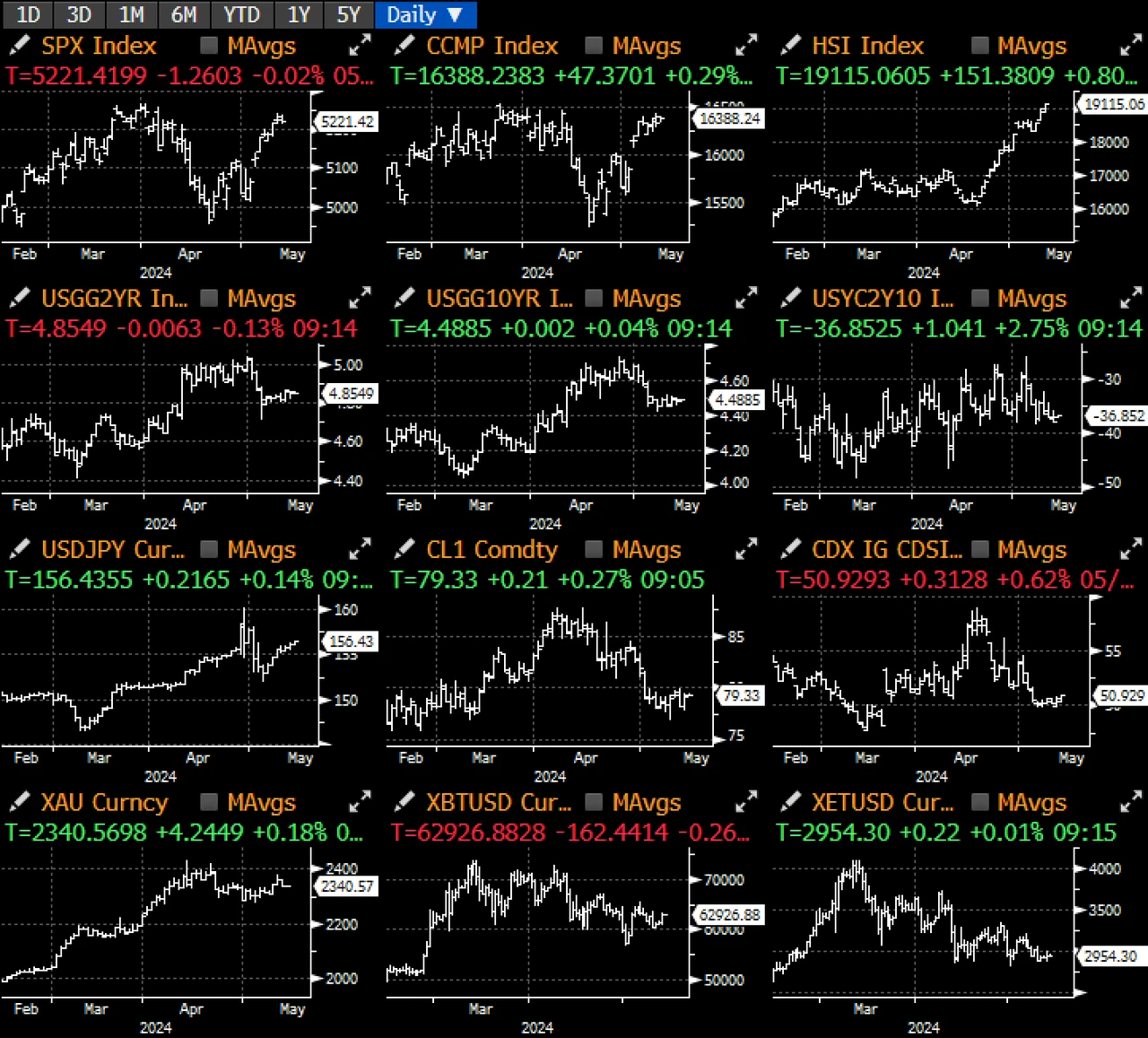

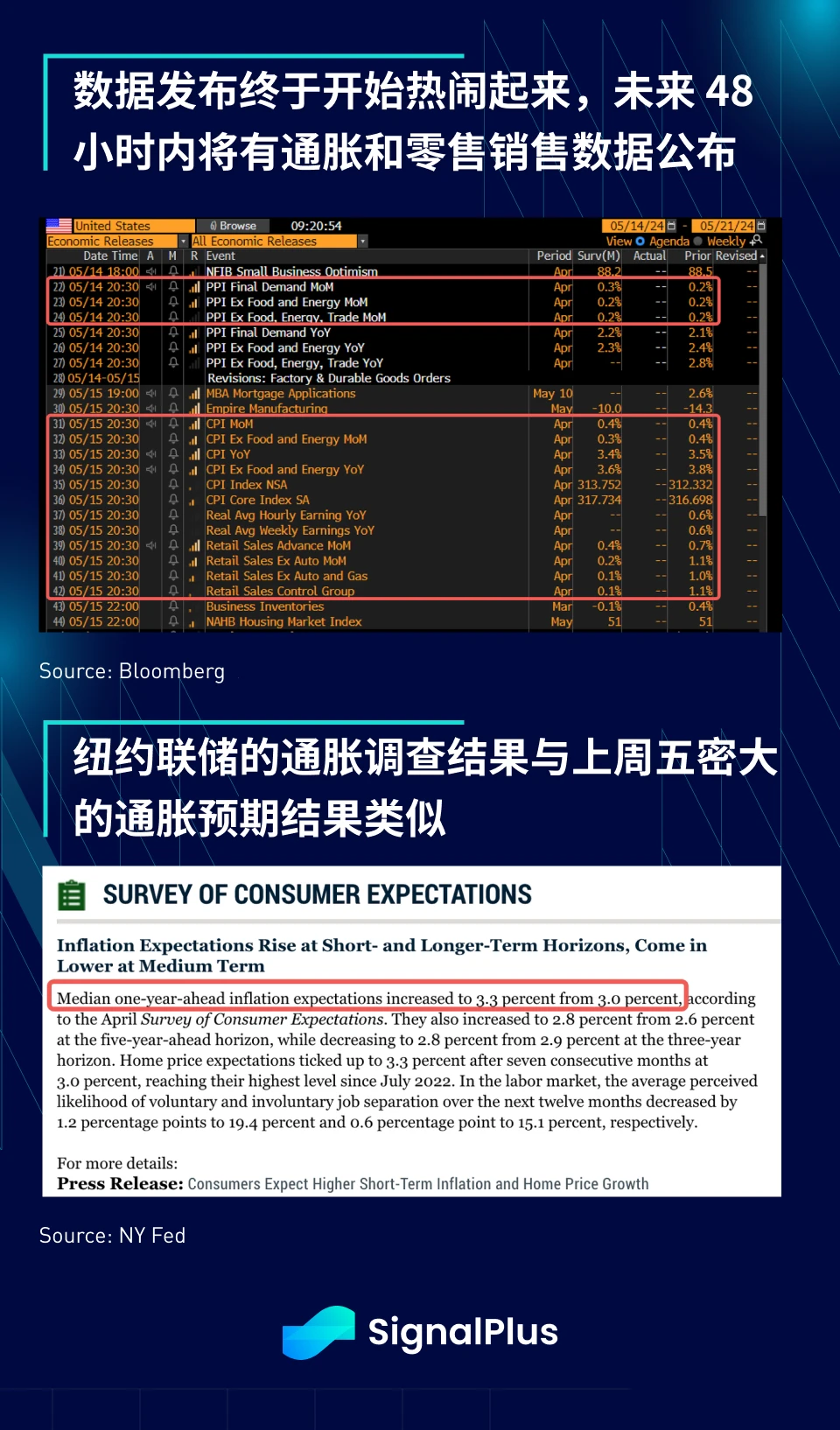

Yesterday the market started the week with a quiet trading day, but there will be longest economic data releases that could affect the market in the next few days, with Tuesday‘s PPI data followed by the important CPI

Yesterday the market started the week with a quiet trading day, but there will be longest economic data releases in the next few days that could affect the market, with Tuesday's PPI data, followed by important CPI and retail sales data on Wednesday, and analysts are busy predicting the outcome of these indicators. At the same time, the New York Fed Consumer Expectations Survey also showed that inflation expectations for the next year Rebound to 3.3% (previously 3.0%), following the rise of inflation expectations in the U.S. Consumer Survey last Friday, marking the first significant Rebound in long years.

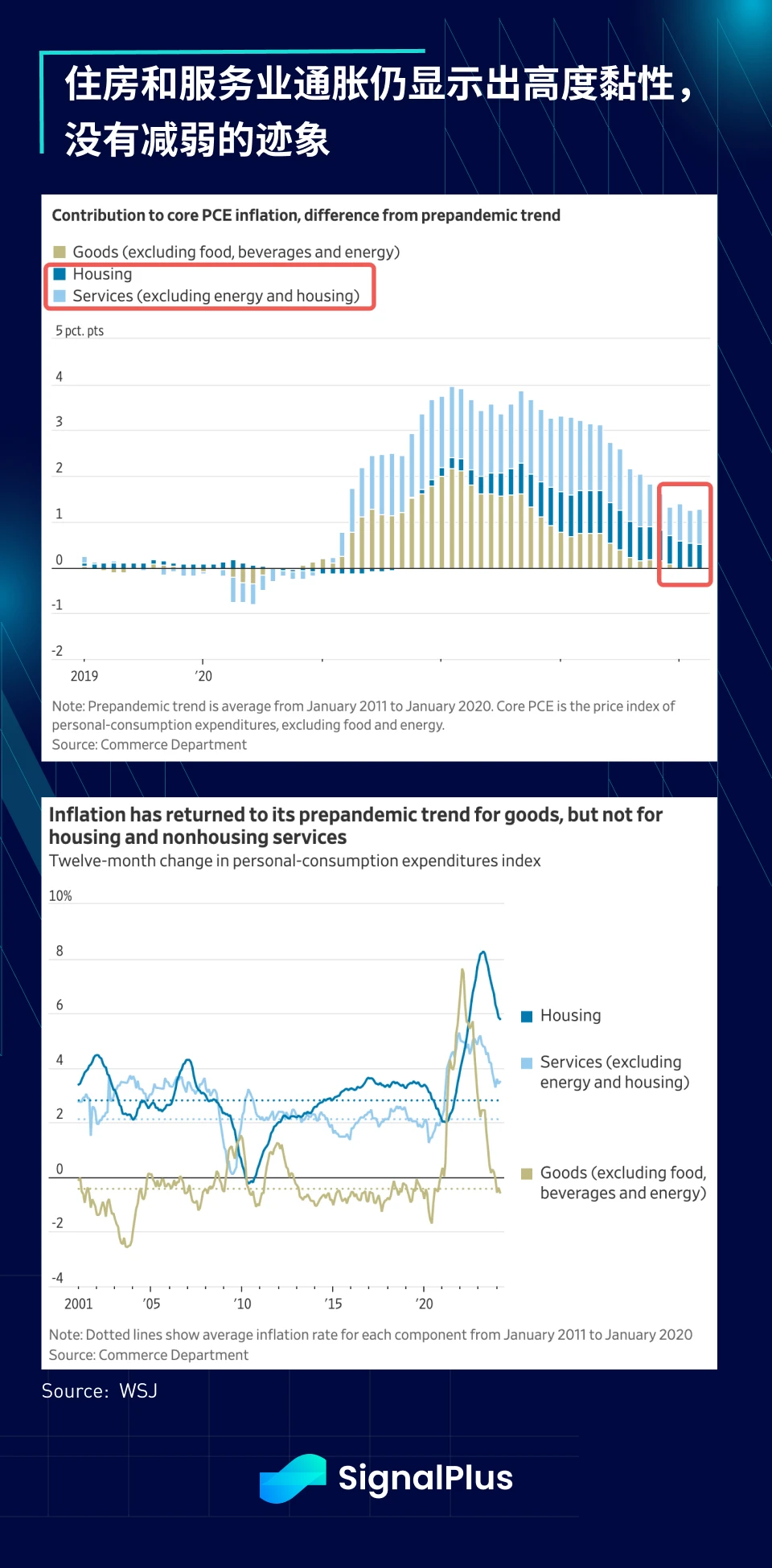

What is evident from this cycle is that housing and services inflation is quite entrenched compared to historical data, with housing supply shortages, rise raw material costs, and stubborn rental prices (has anyone's rent been "lowered" recently?). seems to be the norm in our time, as has been the case with QE/loose monetary policy over the past few decades, which could keep the upcoming nominal inflation at a certain level, but as the Fed tends to endorse its dovish narrative, markets are expected to "over-analyze" the data results in an attempt to find any subtle details or parts that fall short of expectations to match the Fed's narrative.

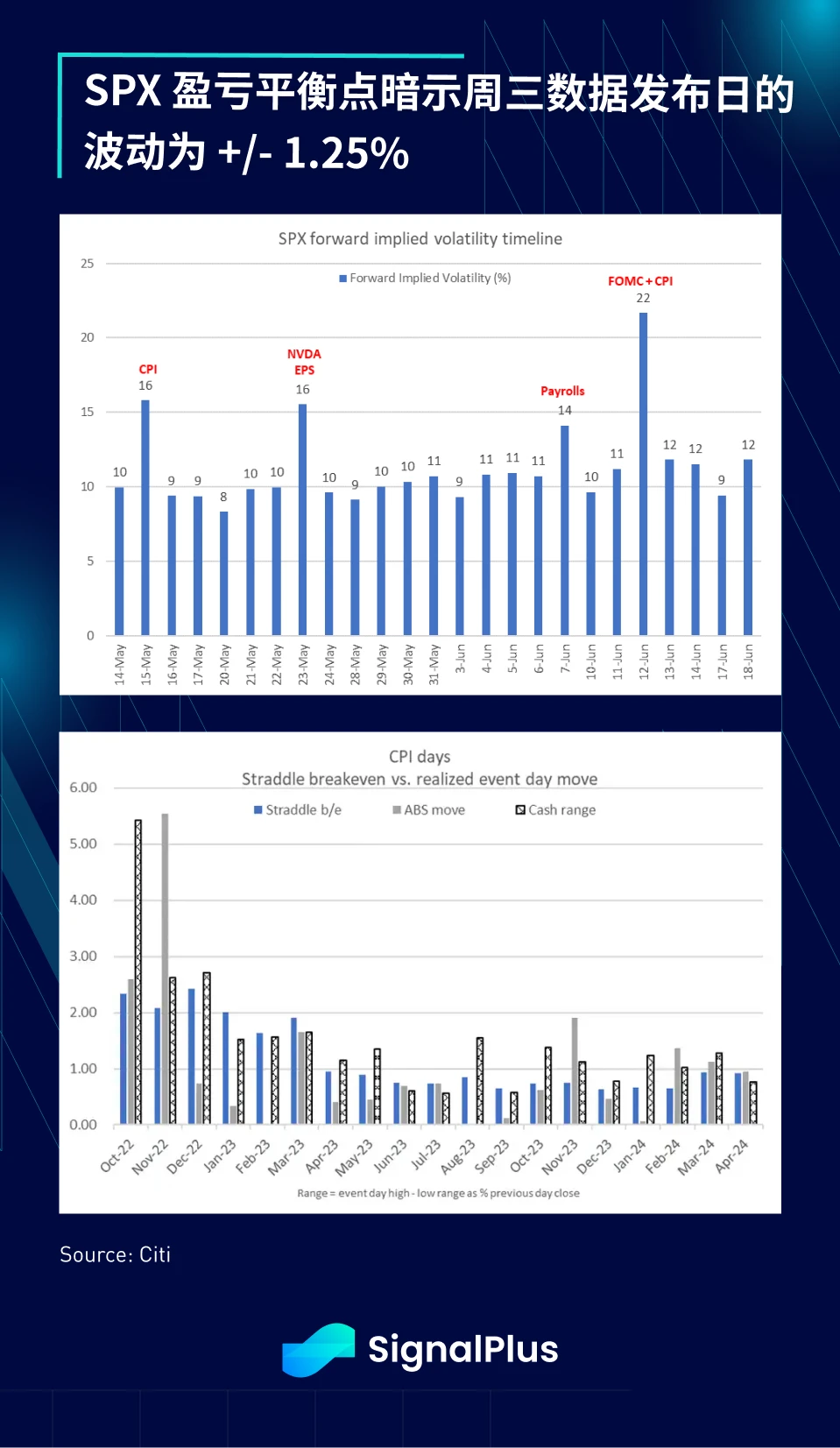

According to Citi's calculations, the SPX has average Fluctuation d +/-1.3% over the past 24 CPI release days, with about 40% of those trading days actually Fluctuation below the 1-day straddle breakeven point and 60% of trading days being higher. The current straddle pricing is similar to March, with a breakeven point of around 1.25%, which is at the high end of the recent fluctuation range, but this expectation is also quite reasonable considering that CPI and retail sales data will be released on the same day. Be careful when trading!

Outside of the CPI, the underlying Volatility measure for equities remains more favorable, with the VIX and its second-order VVIX still in the historically low percentile and the convexity still skewed to the pump, in other words, the SPX delivered stronger returns on the last pump days, while the index has not seen a -2% daily fall since mid-February. Recent monthly and quarterly Fluctuation ranges are also among the lowest in nearly 40 years, along with low implied correlation. In short, the market's ideal outlook remains buoyant, and markets are pricing in more nuanced and indirect Fed policy responses and adjustments from the tiniest macro developments.

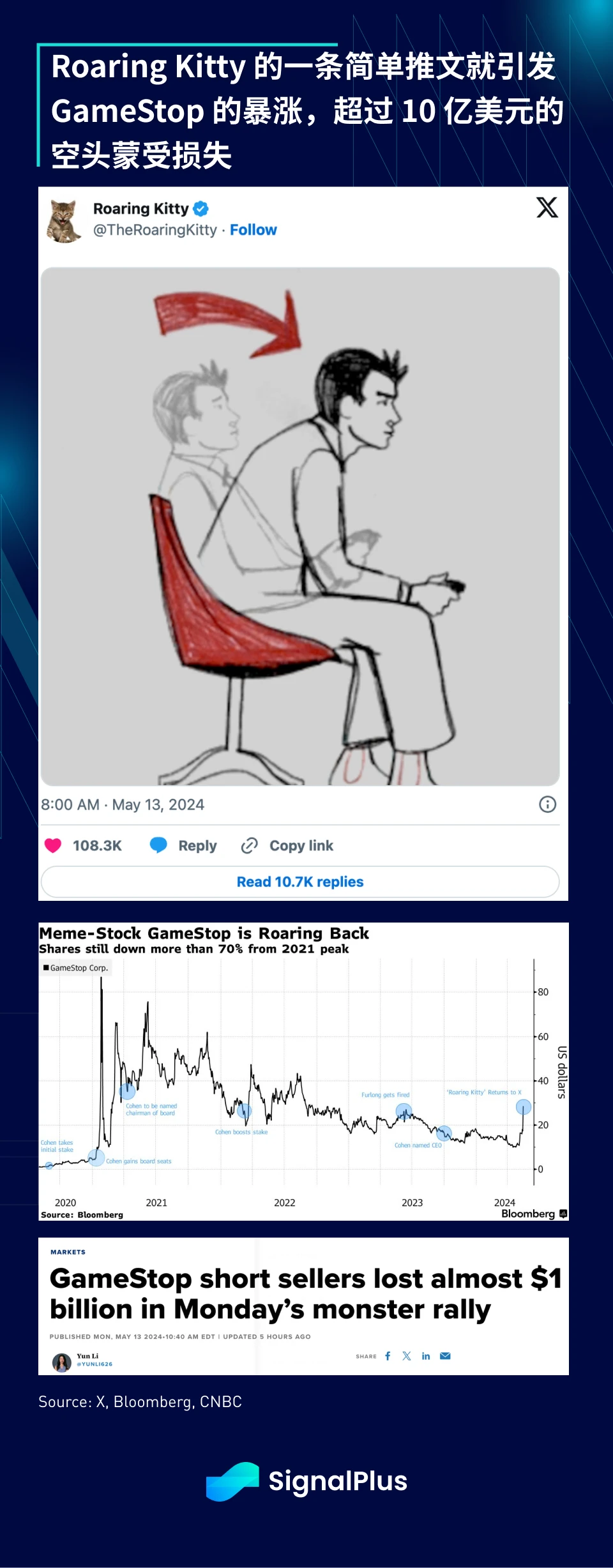

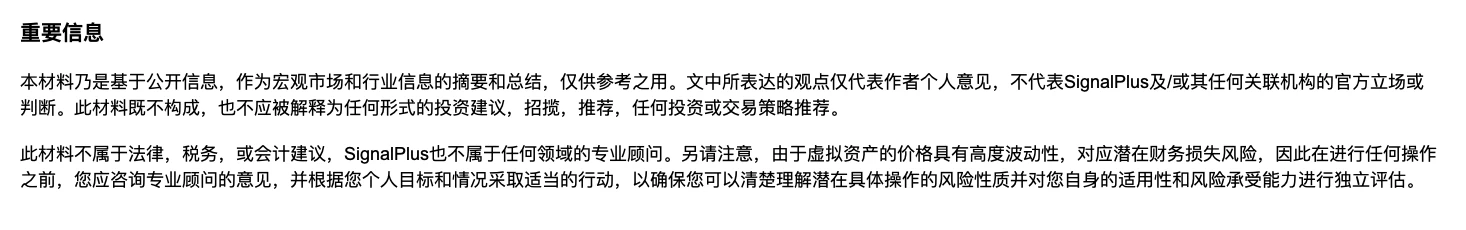

Although the Crypto Assets frenzy has subsided recently, the famous TradFi meme stock OG (Roaring Kitty) made a triumphant return on Twitter (X) yesterday and posted a simple meme without any accompanying information, but his appearance was enough to spur the Gamestop price to soar by more than 100%, causing shortings (pros?). More than $1 billion was lost yesterday, which is reminiscent of the buzzing days during the pandemic. Over the past month, the SPX index has only pump 2%, while the most shorting group of stocks has pump nearly 16%, and the 0 DTE bullish-put options ratio has risen above 1 with a strong volume. Let's see who is the winner?

You can search for SignalPlus in the ChatGPT 4.0 Plugin Store for real-time encryption information. If you'd like to receive updates from us, follow us on Twitter at @SignalPlus_Web3 or join our WeChat group (WeChat: SignalPlus 123), Telegram, and Discord to connect with long fren. SignalPlus Official Website:

- Reward

- like

- Comment

- Share

Solana new star set off a national coin boom and interpreted the fairness and risk points of Pump.fun

Online culture and memes have always played an important role in the encryption market. However, due to the high-risk nature of Meme coins, longest investors are rarely able to profit from them and are prone to huge losses. This situation has led to the fact that value investing in the meme market has become unreliable and speculative and hyped excessively.

However, the traffic attribute of meme has long become an indispensable part of the development of public chains. Therefore, how to maintain the fairness of the meme market has become an important issue in this round of Bull Market. As the largest meme launch platform in the Solana ecosystem, Pump.fun has recently attracted a lot of attention from the market. Pump.fun continues the fairness narrative by allowing users to do so at a very low cost (0.02

By Daniel Li

Online culture and memes have always played an important role in the encryption market. However, due to the high-risk nature of Meme coins, longest investors are rarely able to profit from them and are prone to huge losses. This situation has led to the fact that value investing in the meme market has become unreliable and speculative and hyped excessively.

However, the traffic attribute of meme has long become an indispensable part of the development of public chains. Therefore, how to maintain the fairness of the meme market has become an important issue in this round of Bull Market. As the largest meme launch platform in the Solana ecosystem, Pump.fun has recently attracted a lot of attention from the market. Pump.fun continues the fairness narrative by allowing users to deploy and issuance Token at a fraction of the cost (0.02 SOL) without any development experience. Since its launch in January, the Pump.fun has accumulated more than 460,000 Token issuance. The rise of Pump.fun has also led the meme coin track into a new stage of "coin for all".

01, what is Pump.fun

Pump.fun is a coin tool and social platform focusing on meme coin. It launched on Solana in January 2024 and added support for Ethereum L2 Blast shortly after the Mainnet went live. Pump.fun provides users with an easy and low-cost way to deploy and issuance Token by simplifying the coin process and drop the technical threshold. Users only need to pay a fee of 0.02SOL, and no development experience is required, and the platform can be easily used.

This simplicity and low cost allowed the Pump.fun to quickly gain popularity in a short period of time with remarkable success. Over the past 10 days, Pump.fun's volume has shown a parabolic rise trend, generating a rise of nearly 50% of total revenue. At present, the daily income of the platform is still above $450,000, and there is no trend of decay.

Pump.Fun coin process

Users can currently choose to use Blast or Solana. From there, the startup process is very simple, just click "Start a new hard coin" and enter the name, code, description and brand image, and pay 0.02 SOL to start the "fundraising" issuance process of a Token, the whole process is very simple, users do not need to adjust the number of issuance and token ownership and other settings, the requirements for professional knowledge are very low, and ordinary people can also operate.

Once the new coin is created, the new Token will be launched along the bonding curve on the Pump.Fun platform. A bonding curve is a mathematical curve that determines the price of a Token based on the supply. As more long Token are purchased, Token prices are usually pump. Anyone can buy and sell on the platform, and when the total market capitalization of the token reaches $69,000, the liquidity of the bonding curve will be deposited into Raydium and burned.

When Token's Liquidity is deposited and burned, users can purchase it through Solana DEX Raydium or through their preferred Telegram bot and web application terminal, earning more long Liquidity. Once this is reached, Pump.Fun issuance new coin will look just like any other Token, and by this point, the new coin issuance has succeeded.

Features of Pump.Fun coin

(1) Extremely low coin cost: Anyone can deploy their own meme Token on Pump.Fun at a cost of less than $2.

(2) No need to seed Liquidity: Pump.Fun do not need to seed a large number of Liquidity for a new issuance Token, the system will automatically establish an initial liquidity pool (about $60,000) on the DEX.

(3) Automated process: Once the market capitalization of the new Token reaches $60,000, the system will automatically inject all the purchased funds into the liquidity pool and launch trading on Rayium Swap.

(4) Waiver of the right to mint coin: The creator gives up the right to mint coin when deploying the Token, and all Token are issuance when they are created.

(5) Fair distribution: Since the creator cannot reserve Tokens, all Tokens enter the open market at the time of creation, and there is no hidden Wallet.

(6) High risk and high return: The price of the meme Token on the Pump.Fun is Fluctuation drastic, and there is a serious PUMP&DUMP phenomenon, which is very risky but may also obtain high returns.

02, why Pump.fun can sweep the whole network

With the sharp increase in interest in online culture and meme coin, many long investors are very keen to launch their own Token, but often lack the technical knowledge needed to create a good Token, so the issuance of meme Token has long been monopolized by institutions with technical expertise and deep capital, making it difficult for ordinary users to participate in it.