What is Ethereum?

Introduction

What is Ethereum?

What is Ether?

How Ethereum Works

Important Events

Ethereum Applications You Need to Know

Future Upgrades — The Merge

Misconceptions about The Merge

2022 Major Updates

Conclusion

Introduction

Compared with Ethereum, most people may be more familiar with ETH (ether). They have similar names but different meanings.

Ethereum is an open-source and programmable blockchain that allows developers to build decentralized applications such as IC0 (2017), DeFi (2020), non-fungible tokens (NFTs), EVM and Layer2 Rollups with Solidity. In the crypto world, most innovative projects were established on Ethereum. ETH or ether is the gas fee to be paid when initiating a transaction on the Ethereum blockchain. The gas fee varies with the current demand. After the Ethereum network is merged with the Beacon Chain proof-of-stake system, ETH will also become the staking currency of the new consensus mechanism PoS.

Ethereum is a new application based on the innovation of Bitcoin. The biggest difference between the two is that Ethereum is programmable. Therefore, Ethereum can be used as a platform for decentralized applications, bringing together financial services, games, artworks and various other applications.

What is Ethereum?

Vitalik Buterin, the founder of Ethereum, was born in Russia in 1994 and moved to Canada after his parents divorced. He is very gifted in and passionate about mathematics, programming and economics. His interest in decentralization, or rather, his dislike of centralization came from Blizzard nerfing his favorite World of Warcraft character. At that time, he awakened to the “horrors centralized services can bring”.

After Vitalik Buterin went to university, he realized that traditional education could not give him what he wanted. He also became even more fascinated by decentralization and blockchain technology. The idea of decentralization means being free from the intervention of a central institution. Although at that time, the significance of Bitcoin was still controversial, it attracted Vitalik Buterin so much that he founded Bitcoin Magazine and published lots of articles.

In 2012, he devoted all his time to blockchain-related projects, such as Dark Wallet, Marketplace Egora, and Kryptokit.

In 2013, Vitalik Buterin chose to drop out so that he could focus on blockchain development and travel around the world to meet like-minded people, which laid the foundation for the future development of Ethereum.

2014 was an important year because it was when Vitalik Buterin, at the age of 19, introduced Ethereum, an open-source public blockchain with smart contracts. Ethereum was officially launched in 2015 and is now the most widely used blockchain.

Vitalik believes that Ethereum is an innovation that applies some of the technologies and concepts of Bitcoin to the computing field. But now Ethereum has found its own way and made many dApps possible. Vitalik Buterin promoted the development of blockchain technology and started the era of blockchain 2.0.Vitalik has gained many supporters because of his outstanding contributions to the blockchain industry, his well-recognized competence, and his unique insights into decentralized development. Therefore, the Chinese crypto community refers to him as “V神” (literally “God V”).

What is Ether?

ETH

Ether or ETH is the native token on Ethereum that can be used for transfers, trading, paying fees, etc. It is the only recognized and licensed circulating currency on Ethereum. Ether is the pass on the Ethereum blockchain, because any activity on Ethereum, including transfers, transactions or the creation of new applications, charges ether.

ETH Oil 2.0

If Bitcoin is digital gold, then Ether is digital oil. If you think of Ethereum as a highway and smart contracts as cars, then ETH is the digital oil that provides energy for those cars.

How Ethereum Works

On DeFi Llama, we can see that the total value locked (TVL) on Ethereum has reached $36 billion. On Ethereum, there are various applications other than peer-to-peer payments, such as financial services, artworks and games. Why are so many people willing to put their assets on Ethereum? Maybe the answer will be self-evident as we take a closer look at how Ethereum works.

(Image source: DeFi Llama)

The Blockchain

Ethereum is similar to Bitcoin for relying on the blockchain to store and secure transactions. Both transaction records and smart contracts are on the Ethereum blockchain. We can think of Ethereum as a ledger that keeps track of all activities on the network. This ledger is open and completely transparent to everyone.

Copies of this ledger are distributed across a global network of computers called “nodes”. Nodes perform various tasks, including validating and keeping track of transactions and smart contract data. This structure allows participants to own a copy of the distributed ledger and jointly verify transactions, ensuring the validity of content added to the blockchain.

Why use decentralized nodes to verify transactions and store data?

- No single point of failure (SPOF)

- Transparent, reliable, immutable

- Censorship-resistant

What do nodes store?

- Accounts: Everyone can have his or her own account on Ethereum. Accounts usually have a certain amount of ether.

- Smart Contract Code: Ethereum stores smart contracts. Smart contracts set up the rules that must be met to unlock or transfer funds.

- Smart contracts Status: The status of smart contracts.

Compared with Bitcoin, Ethereum adds smart contracts to the blockchain technology and allows users to create various DApps (decentralized applications). This is the biggest difference between Ethereum and the Bitcoin network. They are on two completely different paths of ecosystem development. Next, let’s learn about the technology that drives all innovations - Solidity smart contracts.

Solidity Smart Contracts

Smart contracts go beyond the first generation of blockchain and expand the applications of the second generation of blockchain. Solidity smart contracts allow the blockchain to operate like a computer instead of only having payment functions as before, which in turn facilitates people to complete more complex transactions through smart contracts.

In 1994, Nick Szabo, an expert in blockchain, explained the concept of smart contracts. He described smart contracts as “automatic vending machines”. People can use vending machines to choose what they want to drink without supervision from a third party.

Smart contracts are not subject to third-party supervision. Code, once deployed to Ethereum, will be permanently stored and cannot be tampered with (even by the project team). Therefore, smart contracts are more credible than traditional finance if the code is carefully audited. But please note that this does not mean that smart contracts are absolutely safe.

DApps deploy new code to Ethereum but they may still be at risk of being hacked. When programs are running smoothly, it is very difficult to detect loopholes. A small error can lead to irreversible consequences. Participating in early innovation is a good thing, but at the same time, people must have a good understanding of the risks as well.

A Brief Introduction of DApps

DApp is the abbreviation for “Decentralized Application”. Because the code and transaction data on Ethereum are fully open and transparent, how a DApp was built and whether there are loopholes can be verified by everyone, which is very different from most mobile and desktop apps.

We can explain DApps by referring to the operating system of smartphones.

The current two mainstream mobile operating systems are Android and iOS. Different blockchains also represent different operating systems. Developers must use a programming language that suits the operating system. Since they are different operating systems, their user base and ecosystems are also different.

Ethereum is currently the most popular operating system with development tools, documents and tutorials. With abundant resources and applications, Ethereum is the first choice for many Web2 developers when they step into the blockchain world and start building DApps.

Gas Fee

Ethereum charges a fee when users try to initiate a transaction or call a smart contract, which is called Gas.

Gas is paid to nodes/miners that assist in validating transactions. They act as a helper in keeping the ledger, providing their own resources and earning income in return.

How to Calculate Gas

Gas Used and Gas Price are essential for calculating gas. Gas Used can be compared to the amount of fuel required for driving the car. Gas Price is the unit price of fuel, and Gwei is the unit of value used to express the price of gas. The smallest unit of ether is Wei (1 ether = 10^18 Wei). It should be noted here that Wei is the smallest unit, but not the only unit.

The following is the formula for calculating gas:

Gas Price * Gas Limit = Gas Fee (transaction fee)

Normally when a smart contract is executed, the gas limit is 21,000.

Suppose we execute a trade today with a gas price of 20 and a gas limit of 21,000. Then we need to prepare 20 * 21,000 = 420,000 Gwei, that is, 0.00042ETH. Please note that this refers to the maximum fee that needs to be paid. If the transaction can be completed without paying that much, the excess will be returned to the user.

EIP 1559 fee adjustment mechanism

Compared with Bitcoin’s supply limit of 21 million, there is no limit for the issuance of ETH. However, Ethereum has this deflation mechanism of burning ether, which restrains the circulation and maintains the price.

Another major event related to gas fees is the EIP-1559 London hard fork upgrade that was implemented in August 2021. The biggest change is to split the transaction fee into “base fee” and “tips”.

Base Fee: The minimum fee needed to maintain the smooth operation of the blockchain. The amount of base fee charged varies with the block capacity. Base fees will be burnt directly and not rewarded to miners.

If users want to speed up their transactions, EIP-1559 allows users to pay additional tips to the miners in addition to the base fee. EIP-1559 affects the income of miners and has caused their dissatisfaction. This proposal introduces a new economic system for Ethereum, in which some base fees will be directly burned. This upgrade also allows gas fees to be more easily predicted, thereby improving the transaction experience. In the case of high network demand, base fees are higher and more ETH will be burned, which will cause a certain degree of deflation.

Ethereum Virtual Machine (EVM)

The Ethereum blockchain doesn’t simply store data, but also runs codes and applications. Smart contracts are compiled and interpreted by EVM.

As the name suggests, the Ethereum Virtual Machine is a virtual machine built on the Ethereum blockchain.Programs running on Ethereum are isolated from each other on EVM and the main chain.

EVM is an Ethereum-native processing system that allows developers to create smart contracts and allow nodes to interact with them. Ethereum developers use a programming language called Solidity. Solidity code can be read by humans, but cannot be understood by machines, so it needs to be converted into instructions that the EVM can read and execute.

When a person sends a transaction to a smart contract deployed on Ethereum, each node runs the smart contract through its own EVM. In this simulation, each node can see what the result is and whether a valid transaction is produced. If all nodes achieve the same valid result, the record will be updated on the blockchain.

Important Events

2013 ~ 2014 From white paper to ICO

At the end of 2013, Vitalik Buterin wrote the Ethereum white paper on his blog, outlining the imagination of various applications. After nearly a year of preparation, they had their first fundraising, which ended up with more than 31,000 bitcoins. The initial sale price of ETH was about $0.3. About 12 million ether were allocated to the Ethereum Foundation and early supporters. 60 million ether were sold to investors.

2015 Ethereum mainnet launch

At the end of July 2015, the update named Frontier launched the Ethereum mainnet. One week later ETH was listed on the exchange Kraken. Due to the high price of nearly $3 on the first trading day, a very high short-term return caused many early investors to sell their ether. The price fell by nearly 50% within a week and went all the way down to around $0.5. The price didn’t stabilize until the mainnet update in September.

In October 2015, the Ethereum Foundation held the Devcon-1 Developer Conference, which attracted lots of attention. After several months of price fluctuations, the price of ETH climbed from $1 to $10 when the update named Homestead took place in March of the following year. The total market capitalization also broke $1 billion.

2016 Hard fork

Homestead contains several protocol and network changes in preparation for other future upgrades. Then one month later, the experimental project DAO was established. DAO is a decentralized autonomous organization similar to a venture capital, using a self-executing smart contract. The creation of DAO attracted more than $150 million in fundraising.

However, within three months, DAO was found to have a loophole in the smart contract and $60 million worth of ether was stolen, which led to the DAO hard fork. Ethereum also experienced a DDos attack soon after. A series of negative events made the price of Ethereum hover around $10 for more than a year. The market cap of 1 billion seemed to be the ceiling for Ethereum.

2017 ERC20-driven ICO

At the beginning of 2017, Ethereum was listed on the social trading investment platform eToro. Bitcoin met the problem of network congestion after the halving event. So people were talking about a possible replacement. Soon the price of ETH soared, starting from $10 and going all the way to $300. But then ETH followed the fall of bitcoin and went back down to $150. However, this was not the end of the rally, but only a temporary correction. The Byzantium upgrade in October caused a shortage of ETH supply. With the catalysis of the Bitcoin price hitting new highs and a large number of IC0 projects, the strong demand for ETH led to strong FOMO in the market. The second wave brought ETH above the $1,000 benchmark, reaching a record high of $1,400 in January of the following year. The market cap of Ethereum also reached $100 billion, making it the second largest cryptocurrency after Bitcoin.

2018 ~ 2019 The silent bear market

2018 was a difficult year for Ethereum. After the market cooled down, there was still a large influx of Bitcoin and Ethereum miners, causing the price to fall from more than $1,000 to less than $100 within a year, and hover between $100 and $300 until Bitcoin’s next halving. The number of ethers in circulation on the market increased to 100 million.

The price performance of ETH in 2019 was not excellent. After the upgrade called Constantinople in February, the price rallied back to $300 but was soon affected by the fall of Bitcoin. The Istanbul upgrade at the end of the year bettered the expansion plan of Layer 2, added interaction with Zcash and improved smart contracts. Then the price of ETH gradually stabilized.

2020 DeFi Summer

In October 2020, Ethereum deployed a staking contract in preparation for the transition to proof-of-stake (PoS). With the recovery of the crypto market and the record high price of Bitcoin, funds started flowing into Ether. The substantial increase of DeFi applications on Ethereum had also increased the market demand for Ether. As the on-chain staking causes a short supply of ETH, the ETH price hit new highs one after another, which had only stopped at $4,300 the following year, increasing its market value by as much as 10 times.

2021 NFT Explosion

In the summer of 2021, with China’s ban on crypto mining and exchanges withdrawal from the Chinese market, the price of ETH fluctuated violently - the price halved to below $2,000 and then rose with the good news of the listing of Bitcoin ETFs. Due to the boom for blockchain games and NFTs, the Ethererum’s London upgrade (EIP-1559) in August has made Ether a deflationary currency, with a total circulation of about 120 million on the market and a new high of $4,800 in early November.

2022 Scaling Solutions

In December, as the Federal Reserve announced to shrink its balance sheet, and Russia’s war in Ukraine broke out in February 2022, funds were pulled out of the high-risk crypto market. The collapse of the algorithm stablecoin Luna in May and the liquidation of leveraged products by many institutions also increased the selling pressure. ETH began to drop from $3,300 earlier this year and fluctuates around $1,000 at the time of writing, making its market capitalization fallen from nearly $500 billion at its peak to $100 billion. Despite the downturn, the ETH 2.0 mainnet upgrade expected to be completed by the end of the year and the growing number of DApps may still drive Ethereum to an ever brighter future.

Ethereum Applications You Need to Know

DeFi (Decentralized Finance)

DeFi is a global financial service system born in the Internet era, which can be regarded as an alternative to the non-transparent, highly-regulated traditional financial market. Anyone who has access to the Ethereum network can use DeFi. No one can prevent others from accessing or being banned from certain DeFi services. You can borrow, lend, and trade cryptocurrencies anytime. The market is always open to all. Some don’t even need to provide identification to borrow millions of dollars.

Since no third-party intervention is required, service costs can be further reduced. And as the DeFi architecture follows previously built smart contracts, it reduces the evaluating time by humans and enables faster asset transactions.

NFT

NFTs (non-fungible tokens) are unique and indivisible, meaning that each NFT has a unique identification code that cannot be tampered with. NFTs mark ownership, which is public for anyone to review on the chain.

Different from NFTs, fungible tokens are what we know as cryptocurrencies, such as ETH, USDT, and BTC. All BTC are exactly the same in nature and functionality.

Although both NFTs and cryptocurrencies are a type of token, they have completely different attributes. At present, the most common token standard for NFTs is ERC-721, while most other cryptocurrencies use ERC-20.

You can imagine NFTs as computers, fans or sofas, which are unlikely to be used as a medium of exchange because of their uniqueness. However, cryptocurrencies are homogeneous, which is determined by their prices. For example, ETH can be exchanged for USDT and vice versa. However, the value of two NFTs may be different, because they may be affected by personal preferences, rarity, etc.

NFTs are applied in a variety of scenarios, such as membership cards, music, game characters, art paintings, etc. It allows artists to give full play to their talents. In addition to that, many clubs issue membership cards in the form of NFTs.

The most well-known NFT project is the Bored Ape Yacht Club (BAYC) created by Yuga Labs. Yuga Labs has further expanded its influence by acquiring the two leading crypto native IPs, CryptoPunks and Meebits, launching $APE token airdrops to BAYC holders, and releasing the Otherside Metaverse later on.

Every move taken by Yuga Labs is closely watched by the public. For those who want to know more about NFTs, following Yuga Labs will be a good way for you to dive deeper into this sector.

(Image source: OpenSea)

Many crypto influencers believe that NFTs are still early in development, and the relevant financial services, such as NFT lending and NFT fragmentation, have yet to be fully developed.

Layer 2

Layer 2, or L2 for short, is a separable blockchain that inherits the security of Ethereum.

Why do we need L2? To answer this question, we must first understand the “impossible triangle” of blockchain: decentralization, scalability, and security.

Most blockchain systems can only meet two of the three characteristics at the same time. If a blockchain enjoys excellent decentralization and security, it will inevitably lose certain scalability, which is also the necessary part that Ethereum needs to upgrade.

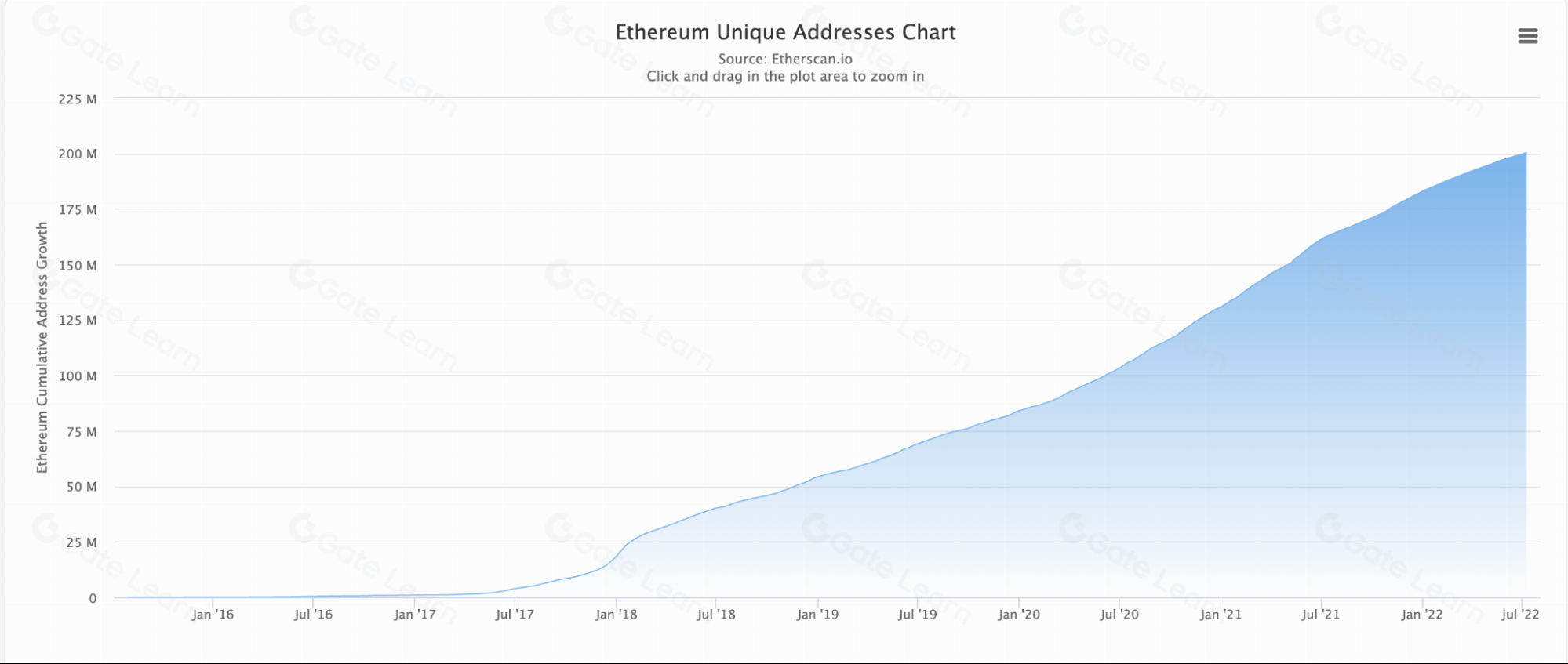

We can see a steady increase of new addresses on Ethereum from Etherscan.

(Image source: Etherscan)

The layer 2 scaling solutions are the most anticipated solution and are most likely to be implemented. Currently, the major scaling solutions include Optimistic Rollup, ZK Rollup, Validium and Plasma.

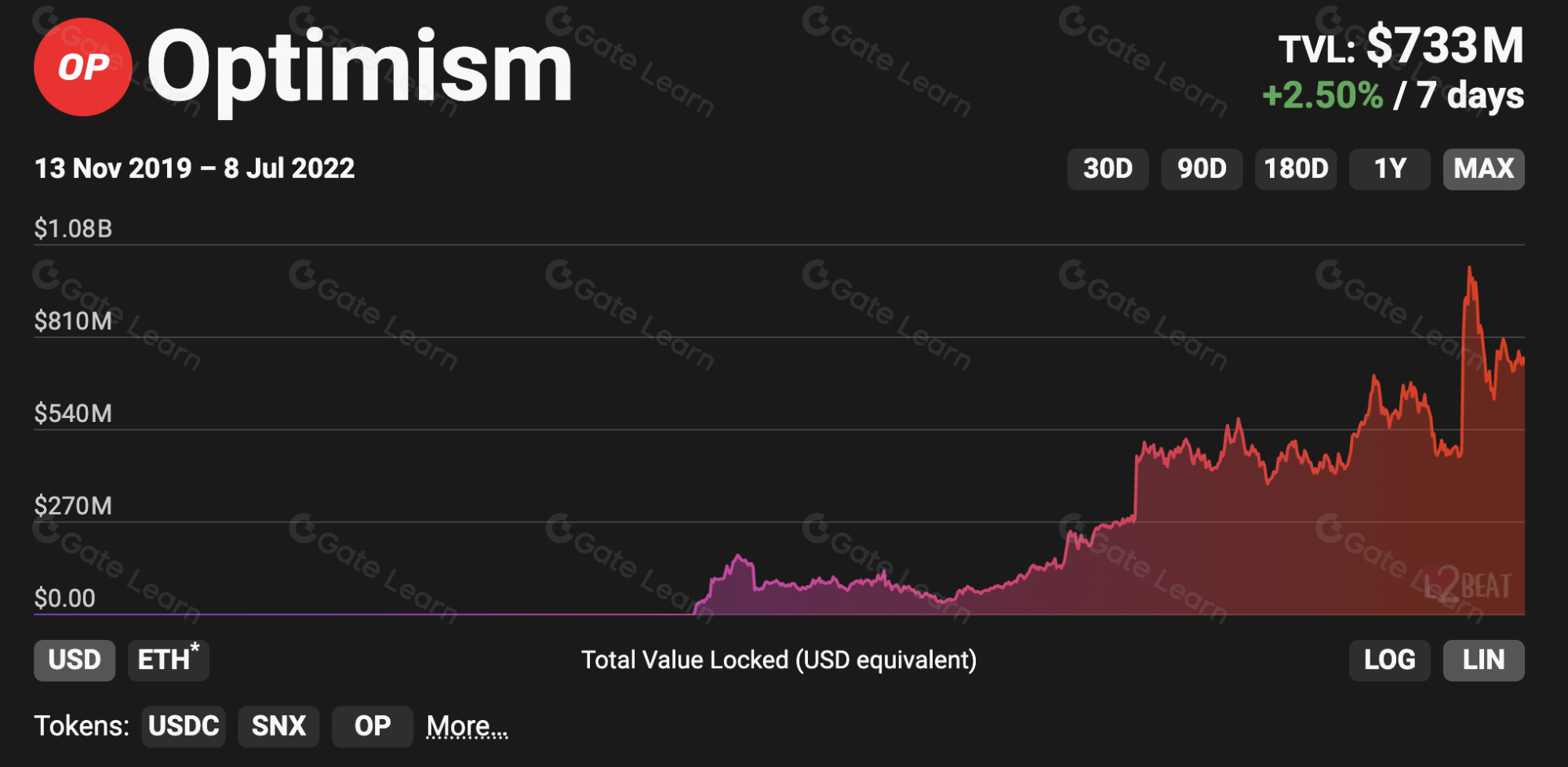

At present, the two most popular layer 2 projects, Arbitrum and Optimism, both use Optimistic Rollup.

In June 2022, Optimism conducted its first airdrop to its early users, which attracted the attention of a large number of users, and the TVL rapidly grew to over $800 million.

(Image source: L2Beat)

Its competitor, Arbitrum, has not issued tokens yet. With Optimism’s lesson, many people have also begun to explore the ecological application of Artiturm.

Arbitrum adopts a different strategy. It launched the Odyssey on June 22, 2022, which allows users to win NFT airdrops by participating in different on-chain projects including cross-chain bridges, NFT, DeFi, and more within a specified period.

(Image source: L2Beat)

DAO

Unlike traditional organizations, the Decentralized Autonomous Organization (DAO) uses smart contracts to make itself automated and trustless. To trust anyone in the organization, you just need to trust DAO’s code, which is 100% transparent and open to all.

Once the code is successfully deployed on Ethereum, the DAO’s funds cannot be used by any single person, nor could its rules be changed unless it is approved through voting. This means that decisions in DAOs are not made by a centralized organization but by the community, because of which, some regard DAOs as the form of future organizations.

A famous DAO is MakerDAO, the issuer of the stablecoin DAI, which currently has the highest DeFi TVL. Holders of its governance token MKR can participate in protocol governance, and the voting rights will depend on the amount of MKR tokens you hold.

(Image source: MakerDAO)

Future Upgrades — The Merge

What Is The Merge?

The Merge represents the joining of the existing execution layer of Ethereum (the Mainnet we use today) with its new proof-of-stake (PoS) consensus layer, the Beacon Chain. Then the proof-of-work will be replaced permanently by proof-of-stake.

The Merge will eliminate the need for energy-intensive mining and instead secures the network with staked ETH. This will enable Ethereum to improve its scalability, security, and sustainability.

(Image source: Ethereum official website)

Initially, the Beacon Chain shipped separately from Ethereum Mainnet, which, with all its accounts, balances, smart contracts, and blockchain state, continues to be secured by proof-of-work, even while the Beacon Chain runs in parallel with proof-of-stake.

Let’s draw an analogy between Ethereum and a spaceship that isn’t quite ready for an interstellar voyage. And the Beacon Chain is like a community-driven new engine and a hardened hull. After a long period of testing, it’s almost time to upgrade the new engine to be safer and more efficient and to merge the new engine into the existing ship, which will lead us to embark on an exploration.

Merging with Mainnet

Since genesis, proof-of-work has secured the Ethereum Mainnet, which contains every transaction, smart contract, and balance since it began in July 2015. But as more and more people join the Ethereum network, the energy it consumes continues to expand.

Throughout Ethereum’s history, developers have been working hard preparing for an eventual transition away from proof-of-work to proof-of-stake. In December 2020, the Beacon Chain was launched, which has existed as a separate blockchain to Mainnet since then.

The Beacon Chain has not been processing Mainnet transactions. Instead, it has been reaching consensus on its own state by agreeing on active validators and their account balances. After extensive testing, the time it takes to reach consensus on Beacon Chain was much less. After The Merge, the Beacon Chain will be the consensus engine for all network data, including execution layer transactions and account balances.

The Merge represents the official switch to using the Beacon Chain as the engine of block production. Mining will no longer be the means of producing valid blocks. Instead, the proof-of-stake validators assume this role and will be responsible for processing the validity of all transactions and proposing blocks.

What do I need to do to get ready?

As a holder of ETH or user on Ethereum, you do not need to do anything to protect your funds with The Merge looming. However, you should be on high alert for scams such as the “ETH2” token that tries to take advantage of users during this transition. Be sure to protect your funds to remain safe.

The ETH after The Merge

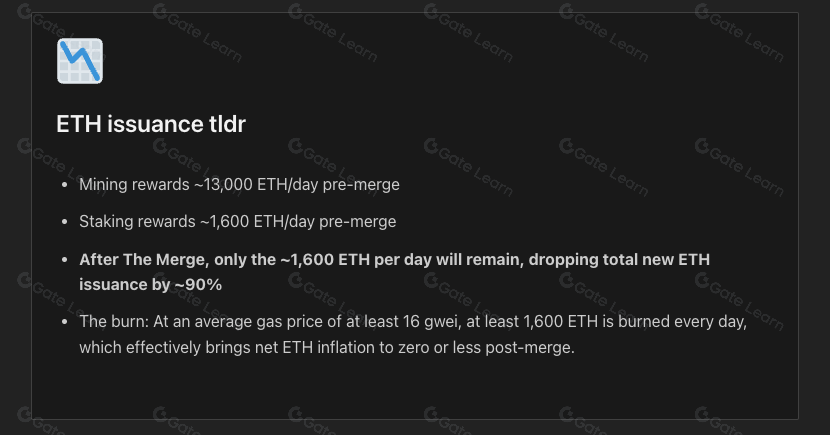

As the consensus is upgraded, the issuance of ETH will be affected by The Merge. We can look at the supply of Ethereum in two aspects: issuance and burn.

Issuance will produce more ETH tokens, while burning means destroying existing ETH and removing it from circulation. The ratio of issuance and burning will determine whether ETH is inflationary or deflationary.

Under the proof-of-work mechanism, 13,000 ETH are created daily.

After transitioning to PoS, 1,600 ETH will be created per day, decreasing new releases by 90%.

(Image source: Ethereum official website)

During the upgrade of Constantinople, the reward for each block (created about every 13.5 seconds) was set to be 2 ETH. After the consensus mechanism’s transition to PoS, verification is no longer an economically intensive activity, so there is no more need for high returns.

At present, the issuance of ETH comes from the execution layer of the PoW mainnet and the consensus layer of the PoS Beacon Chain. After The Merge, the issuance will be fully controlled by the PoS consensus layer.

Misconceptions about The Merge

Running a node requires staking 32 ETH.

False. Anyone can run nodes.

There are two types of Ethereum nodes: One is nodes that can propose blocks, which includes mining nodes under PoW and validator nodes under PoS.

The other is nodes (the majority of nodes are grouped to this type) that can be verified by anyone. It is not required to commit any economic resources (CPU and hash power in PoW, or the 32cstaked ETH in PoS) beyond a consumer-grade computer with available storage and an internet connection.

These nodes do not propose blocks, but they still serve a critical role in securing the network by holding all block proposers accountable by listening for new blocks and verifying their validity according to the network consensus rules.

Running a non-block-producing node is possible for anyone under either consensus mechanism (proof-of-work or proof-of-stake); it is strongly encouraged to all users if you could. Running a node is immensely valuable for Ethereum and gives extra benefits to any individual, such as improved security, privacy and censorship resistance.

Gas fees will drop after The Merge.

False. The Merge is a change of consensus mechanism, not an expansion of network capacity, and will not reduce gas fees.

Gas fees are necessary in the Ethereum network. The Merge changes the consensus mechanism to proof-of-stake but does not significantly change any parameters that directly influence network capacity or throughput.

Transaction speed will be significantly improved after The Merge.

False. The “speed” of transactions will improve slightly, but not in a way that users will notice.

On proof-of-work, we have a new block every 12~14 seconds. On the Beacon Chain, slots occur precisely every 12 seconds. On proof-of-stake blocks will be produced ~10% more frequently than on proof-of-work. This is a fairly insignificant change and is unlikely to be noticed by users.

You can withdraw staked ETH once The Merge occurs.

False. Staking withdrawals are not yet unlocked with The Merge. The following Shanghai upgrade will enable staking withdrawals.

Shanghai upgrade is the next major upgrade following The Merge. This means that newly issued ETH will accumulate on the Beacon Chain and remain locked for at least 6-12 months after The Merge.

Validators will not receive any liquid ETH rewards till the Shanghai upgrade when withdrawals are enabled.

False. Fee tips/MEV (Miner extractable value) will be credited to a Mainnet account controlled by the validator, available immediately.

ETH on the execution layer (Ethereum Mainnet as we know it today) is accounted for separately from the consensus layer. When users execute transactions on Ethereum Mainnet, ETH must be paid to cover the gas, including a tip to the validator. This ETH is already on the execution layer, not newly issued by the protocol, and is available to the validator immediately.

When withdrawals are enabled, stakers will all exit at once.

False. Validator exits are rate limited for security reasons.

An important caveat here, full validator exits are rate limited by the protocol, so only 1,340 validators may exit per day, or only 43,200 ETH per day. This rate limit prevents a potential attacker from using their stake to commit an offense and exiting their entire staking balance in the same epoch before the protocol can enforce the slashing penalty.

2022 Major Updates

- 2022-03-14 Kiln Merge Testnet completed and is now running entirely under proof-of-stake.

2022-05-30 The Ropsten Beacon Chain went live in May 2022 and became the first longstanding testnet to run through The Merge in June.

2022-06-16 The Gray Glacier upgrade is scheduled to occur at block height 15,050,000. The upgrade changes the parameters of the Ice Age/Difficulty Bomb, pushing it back by 700,000 blocks, or roughly 3 months.

2022-06-21 - Early 2022 The Kiln Merge Testnet will be shut down shortly after the Ethereum mainnet’s transition to proof-of-stake. Ropsten, Ethereum’s longest-lived proof-of-work testnet, has transitioned to proof-of-stake and will be shut down in Q4 2022. Rinkeby, a geth-based proof-of-authority testnet, will not transition to proof-of-stake and will be shut down in Q2/Q3 2023. The two testnets which client developers will maintain after The Merge are Goerli and Sepolia.

2022-06-30 Sepolia will be the second of three public testnets to run through The Merge.

Conclusion

Ethereum is undoubtedly the main place for innovation as it enjoys the most advanced blockchain technology and the most diverse ecosystem.

The emergence of Solidity smart contract has created infinite possibilities for the decentralized world, produced a number of ground-breaking applications and concepts, opened up the prosperous era of DApp, and facilitated the development of most core applications such as DeFi, NFT, Layer 2, etc. All of these started on Ethereum, and then expanded to other public chain ecosystems.

Nonetheless, Ethereum, as the technology created in 2015, is somewhat unable to meet the ever increasing user demands. The spillover value has allowed other new public chains to develop unique ecosystems of their own, such as Solana that supports tens of thousands of transactions per second, Avalanche that has a unique architecture of three blockchains, and Flow that is designed for NFTs, etc.

Compared with the new blockchains, Ethereum still has a considerable room for improvement in scalability. The Ethereum Foundation and developers from various decentralized ecosystems are working together to improve this situation. EVM and Layer 2 are two of the solutions among others.

With the time changing, experience accumulating, and technology advancing, we believe that, in the near future, we will witness major changes brought about by Ethereum’s future upgrades, and also a more diverse blockchain world.